Digital Transaction News reports on the recent Javelin Strategy and Research Study which says Online Sales shouldn't be hurt to badly. I tend to go with the idea that bricks and mortar will be hurt not only by the economy, but "at the expense" of people trickling...should I say flocking...to e-commerce. (see graphic below right from when I talked about about the Paradigm Shift.

A Sour Economy Won’t Hurt Online Shopping Or Alternative Payments(November 12, 2008) Retail sales are slumping and stores are closing, but the online retailing channel—and thereby online payment transaction volumes—will come through relatively unscathed, according to a new report from Javelin Strategy and Research. Javelin’s latest online retail payments forecast predicts Internet retail purchases will total $148 billion this year, up 10.4% from an estimated $134 billion in 2007.

That’s much better than the outlook for overall retail sales. The U.S. Commerce Department recently estimated that retail and food sales adjusted for seasonal variations but not price differences were down in September by 1.2 % from August and by 1.0% from September 2007. The government’s estimate for October is due Friday, and many retailing analysts are predicting the worst Christmas spending season in years.

Wednesday, November 12, 2008

Sour E-conomy Doesn't E-qual Sour Grapes for E-Commerce

PCI DSS Version 1.2 Webinar

Want a Crash Course in Understanding PCI DSS Version 1.2?

The PCI Security Standards Council, the standards body providing management of the Payment Card Industry Data Security Standard (PCI DSS), PIN Entry Device (PED) Security Requirements and the Payment Application Data Security Standard (PA-DSS), has announced it will be offering a complimentary webinar,

"Understanding PCI DSS Version 1.2...to be held on Tuesday Nov. 25, 2008 at 11:30 a.m. EST (and at 7:30 p.m. EST.)

The session will be repeated on Wednesday Dec. 17, 2008 at 10:30 a.m. EST and 8:30 p.m. EST.

These one hour webinars are designed for merchants and service providers who are implementing the PCI DSS and want to better understand the changes brought about with version 1.2 which was released on Oct. 1, 2008. The series and will feature Bob Russo, General Manager of the Council and Lauren Holloway, Chairperson of the Council’s Technical Working Group. During each session Mr. Russo and Ms. Holloway will address key elements of version 1.2 and what it means for any organization’s compliance efforts.

Webinar participants will discover:

- Elements of each of the 12 requirements of version 1.2;

- What has changed from version 1.1

- Key dates for version 1.2;

- The intent of the Council in making any changes.

To register for the 11:30 a.m. EST session on Nov, 25 click http://register.webcastgroup.com/event/?wid=0801125084404 and for the 7:30 p.m. EST session click http://register.webcastgroup.com/event/?wid=0801125084405.

To register for the 10:30 a.m. EST session on Dec. 17 click http://register.webcastgroup.com/event/?wid=0801217084406 and for the 8:30 p.m. EST session click http://register.webcastgroup.com/event/?wid=0801217084407.

These webinars will be recorded and available for download on the Council’s Web site for those who cannot attend any of the sessions.

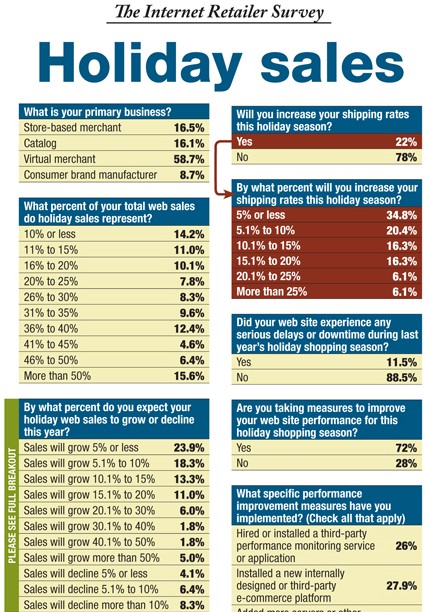

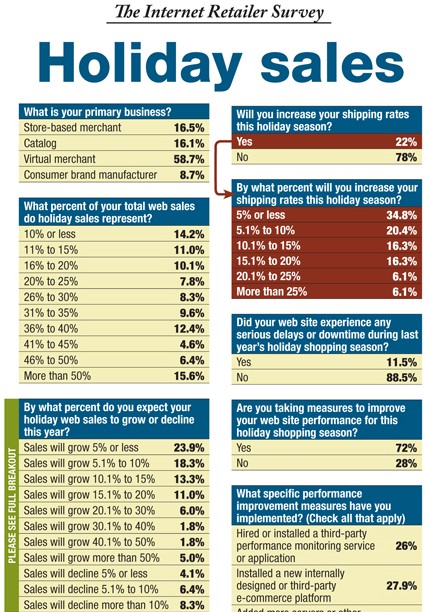

Internet Retailer: 81% Believe Holiday Online Sales Will Grow

InternetRetailer.com - As the economy sinks, will the sleigh rise?

Even in the midst of economic chaos, 81% of retailers believe their online sales will grow this holiday season

By Bill Siwicki

With the economy teetering on the brink and consumers frazzled by the sinking stock market and manic efforts of elected officials, the big question in retail today is: Will holiday sales this season be HO-HO-HO or HO-OH-NO? It depends on the sales channel, retailers, research firms and analysts say. Sales have been down this year, in some cases significantly, in bricks-and-mortar stores. However, online sales continue to grow—though not at the rapid pace of years past.

Even amid economic turmoil, 81.1% of retailers believe their holiday web sales will grow to some degree this season, according to the latest Internet Retailer survey. This is good news—for the most part, some analysts say.

“It is encouraging to see four out of five expect to grow web sales in the face of such a poor economy,” says Jim Okamura, senior partner at retail consulting firm J.C. Williams Group Ltd. “However, that one-in-five figure is higher than I’ve seen in a long time, especially in the face of continuing online sales growth where the focus being paid to the online channel has never been higher.”

Continue Reading at Internet Retailer.com

New Look Quarterly from Forrester Research

Received an email from Forrester Research and found it interesting enough to share. I'm sure they don't mind since they invited me to share/email this with anyone, so I am. This particular report aims to provide insight from eBiz-execs seeking to grow their eBiz.

If you'd like further information on how to subscribe to First Look Quarterly's you may click here. If you'd l ike to participate in their eBusiness Panel, you can sign up here. Here's the email:

Welcome to the new First Look designed specially for eBusiness & Channel Strategy professionals!

Whatever your politics, you can't envy Barack Obama. He's just walked into the biggest economic disaster in American history. Housing prices are plummeting, businesses are unable to raise capital, unemployment is rising, the stock market hasn't displayed signs of a bottom yet, and consumer confidence is at the lowest level since the University of Michigan even started to measure the metric. There's a guy out there who calls himself Dr. Doom who thinks that it could take decades to recover. It's enough to make just about anyone want to crawl into a hole and hibernate until there's better news.

Anyone, that is, but an eBusiness manager. Because if there is a silver lining in this cloud, it is that the online sector of nearly every consumer-facing business continues to experience growth and garner executive attention. From a Forrester survey of eBusiness executives, we know that the key reasons why an online business exists are to acquire new customers, reduce the current cost of servicing customers, and retain existing customers. The impact of the Web channel is clear and quantifiable, and that should leave you in pretty good shape.In fact, 72% of retailers said that the Web channel is better suited to withstand an economic slowdown than other channels. But a downturn is never a good thing, and companies have a bad habit of killing even the geese that lay the golden eggs during tough times. What are the things you need to be prepared for?

We see three:So what to do? eBusiness managers should be doing several things to address these changes. In the short term, we suggest three strategies.

- A continued slump in consumer confidence. With all the bad news out there, how can customers or businesses possibly be anything but uncertain about the future? Your Web site is in a unique position to address this challenge.

- Demand for value. If "trading up" was the catchphrase of the last decade, you can bet money that "trading down" will be an imperative for indebted, cash-flow-negative consumers to get the most out from the limited resources they do have. Is it any wonder that Wal-Mart, whose mantra is "Everyday low prices," is one of the only stores to experience positive comp store sales in recent months?

- High customer acquisition costs. As consumers and businesses are tighter with their wallets, marketing spend is less likely to yield much bang for the buck. That means focusing on your customers who know you, love you (or at least tolerate you), and are likely to spend more with you. In other words, this means more need to focus on customer retention.

Addressing customer confidence issues in your digital contact points. If your business is in good shape, don't be afraid to trumpet it -- on your home page, on log-in pages, in your emails. We received an email from Citizens Bank recently that said just that: The times are uncertain, but your deposits are not. What a comforting message during turbulent times that many eBusiness executives ignore. In fact, one in five US online travelers avoids destinations because a Web site's content doesn't make them feel comfortable; 26% cite the same problem with hotel Web sites.

Boosting customer care. There may be places to cut funds, but if you are in an industry where consumers are skittish, make sure that you have human help on hand to answer questions and allay concerns. When consumers want customer service, they are most likely to either go to a store or call a service rep. Interactive chat and click-to-call show promise, especially for online banking sites. In a recent survey, we found that while 85% of researchers who contacted a firm during the research process used the phone, just 43% found that method helpful. By contrast, just 47% used click-to-call, but satisfaction rates were significantly higher at 61%

Perfecting retention marketing strategies. The king of all digital retention tactics is email marketing, and it's time to make sure you're not just batching and blasting your entire customer base with irrelevant messages. Segment your best customers, and create useful content that will engage them and give them a reason to interact with you even when their liquidity is low.

That's just the tip of the iceberg. We have many documents that we've published recently and have on our docket in the coming weeks to advise various eBusiness groups on weathering the economic storm. The good news is that if you're reading this, you'll likely be one of the players that not only emerges from this downturn intact, but stronger and better than before.

Seeing the glass half full,

Sucharita Mulpuru

Research Referenced In This Issue

Brand-Building Online Content Matters For eBusiness And Channel Strategy In A Recession (47266)

How To Get Customers To Shop Online (45822)

Optimizing Customer Retention Programs (44400)

The Business Case For Interactive Help In Financial Services (42472)

The Cost Of eBusiness Operations And Customer Acquisition (46111)

The State Of Retailing Online 2008: Profitability, Economy, And Multichannel Report (45508)

Tuesday, November 11, 2008

Short Circuit in Gift Cards?

If You've got a Circuit City Gift Card, Use it Now!

Circuit City tried to reassure shoppers that it would be business as usual despite its Chapter 11 bankruptcy filing.

Circuit City tried to reassure shoppers that it would be business as usual despite its Chapter 11 bankruptcy filing.

They've asked a bankruptcy court to let it honor gift cards. That's simply rhetoric to reassure gift card holders. In reality, the gift cards are about to "short-circuit" both in the context of their future as an acceptable electronic payment and the time they'll be around.

The purpose of bankruptcy is to "restructure" but having heard rhetoric following the Pay By Touch "bankruptcy" filing and imminent "restructuring," I'd advise consumers to take into account the fact that Circuit City is a retailer in serious financial trouble. That will affect their gift cards. Sorry...I'd love to paint a rosier picture, but a "Sharper Image" comes to mind instead. (To refresh your memory, their gift card holders lost everything)

So if you have a Circuit City gift card use it immediately. In fact, I'd advise that you do that across the board with any retailer where you have a prepaid gift card.

In this environment, I've got 3 words for you..."use it now". In the past, people have shown a tendency to hold on to the gift cards for a couple of months. I'm not a big believer in gift cards, they're the opposite of a layaway program...you're basically "loaning" money to the retailer and getting nothing in return.

But if you must get one, and not many are considering it this holiday season (see previous post) instead of dolling out your hard earned cash for a store branded (closed loop) gift card, you should only "consider" purchasing a gift card that is Visa/MC/Discover/AMEX branded/backed, (open loop cards)

I wouldn't be the least bit surprised, if and when the Circuit City gift cards do indeed short-circuit, to see the gift card landscape vastly affected forever. They'll either be some new regulation introduced, someone will come up with an improved program or consumers will shy away, at least from...closed loop gift cards.

Holidaze - Only 1.1% Will Use Credit Cards More

Cash is king for U.S. holiday shoppers: survey | U.S. | Reuters

CHICAGO (Reuters) - Cash is king this holiday season as consumers try to limit their credit card purchases or have maxed out on credit altogether, according to a survey conducted for Reuters.

A total of 88.6 percent of those surveyed said they would use more cash for buying holiday gifts this year, while 59.7 percent said they will use credit cards less, according to the survey by America's Research Group.

Only 1.1 percent said they will use credit cards more.

These stark differences could be partly due to consumers feeling more credit pressures as the economy weakens and banks become less willing to extend credit, said Britt Beemer, chairman of consumer tracking firm America's Research Group.

But another, even larger reason could be that many consumers -- 43.2 percent -- will give gift cards less often this year because they are worried that those cards would be worthless if a retailer files for bankruptcy.

Consumers who shy away from gift cards may just give cash instead, he said.

"If the only store I know of (that) is going to be around for sure is Wal-Mart, and I don't want to give a girlfriend a Wal-Mart gift card, cash is a lot more sexy," Beemer said.

The 2008 holiday season is shaping up to be challenging, at the very least, for retailers. The National Retail Federation has forecast the lowest increase in spending by consumers in at least six years.

Adding to the pressure for traditional retailers is the fact that bankrupt retailers like Circuit City are liquidating inventory at stores they are closing. One-third of survey respondents said they will go to liquidation sales in place of their normal retailers this Christmas.

Consumers are also trying to spread the pain across several paychecks, with 65 percent saying they plan to buy a few gifts each week and 31 percent saying they started shopping early so they would not have a big bill in one month.

One positive for retailers? The move to give cash instead of gift cards could lift sales during the holiday season, Beemer said. "If somebody has cash, they spend it immediately," he said. "If somebody has a gift card, it rolls on to next Memorial Day or July 4 weekend."

Another positive factor could be lower gasoline prices, with 35.4 percent of respondents saying that lower gas prices will encourage them to spend more.

The survey consisted of 1,000 interviews conducted November 6-8 and has an error factor of plus or minus 3.8 percent.

Get Faced on Facebook!

Facebook users are being warned to watch out for Nigerian scammers masquerading as friends on the social networking site, after an Australian woman was sent a message asking for money from a conman who had hacked into her friend's account.

Google employee Karina Wells (pictured on left) told the Sydney Morning Herald (SMH) she was sent a message from a friend's account which claimed he was stranded in Lagos, Nigeria, and asked her to send A$500 for a plane ticket. She became suspicious when he used the term "cell" vs. her friend's normal use of the word "mobile" and turned the tables on the scammer.

Google employee Karina Wells (pictured on left) told the Sydney Morning Herald (SMH) she was sent a message from a friend's account which claimed he was stranded in Lagos, Nigeria, and asked her to send A$500 for a plane ticket. She became suspicious when he used the term "cell" vs. her friend's normal use of the word "mobile" and turned the tables on the scammer.

Here's the original story in the Sydney Herald:

"Cyber criminals target Facebook users - Security - Technology - smh.com.au

Asher Moses

November 10, 2008 - 2:27PM

Facebook has been infiltrated by Nigerian scammers and other cyber criminals who use compromised accounts to con users out of cash.

Now that even non-tech savvy internet users know not to respond to, or click on links in, emails from strangers, online thieves have turned to social networks and are finding it is easier to trick people when posing as their friends.

On Friday, Sydney-sider Karina Wells received a Facebook message from one of her friends, Adrian, saying he was stranded in Lagos, Nigeria, and needed her to lend him $500 for a ticket home.

Adrian used relatively good English but, after chatting further, words such as "cell" instead of "mobile phone" tipped Wells off that she was not talking to her friend but someone who had taken over his account.

Using sites such as Facebook allows scammers to research and target victims more effectively and avoid having their messages blocked by spam filters, said Paul Ducklin, head of technology at Sophos Asia Pacific. It is likely the scammer obtained Adrian's Facebook login details after he was infected with a virus delivered by email or in an infected web page.

There are a number of viruses which, once installed on a computer, send back to the hacker a detailed log of everything entered using the keyboard, including online banking details and passwords for services such as Facebook.

Wells played along with the scammer, who asked her to transfer the money into a Western Union account. "Naturally I was concerned as, to all intents and purposes, this seemed to be legitimate," she said. "I pretended that I would help, obtained all the details of where he was and forwarded them to both Facebook and the relevant authorities."

But while the Nigerian scammer used the compromised Facebook account coupled with social engineering tactics to try to convince Wells to hand over money, many are using compromised accounts to spread malware.

Typically, the victim receives a Facebook message from a friend with a subject such as "LOL. You've been catched on hidden cam, yo" or "Nice dancing! Shouldn't you be ashamed?" The body of the message contains a video clip link that appears to go to a legitimate site such as Facebook or YouTube but, when clicked on, it takes the user to a bogus web page. Before the users can play the video they are told they need to download a video player upgrade, which is in fact a password-stealing virus. The next time the victim logs into Facebook the malware-laden message is sent to all of their friends and the infected link is automatically added in comments on friends' pages.

Other less sophisticated attacks on Facebook members use spam emails, some appearing to come from Facebook itself, to spread viruses.

In September security firm WebSense reported on spam emails, purportedly sent from an @facebookmail.com address, that tell the victim they have received an invitation from Facebook to add a friend. "The spammers included a zip attachment that purports to contain a picture in order to entice the recipient to double-click on it. The attached file is actually a Trojan horse," WebSense said.

PayPal Says 70% to Cut Holiday Shopping

70% of online shoppers to cut spending during holiday season according to PayPal

Study shows that throughout the holiday season, 70 percent of US online shoppers have expressed their intention to cut back on their spending.

Study shows that throughout the holiday season, 70 percent of US online shoppers have expressed their intention to cut back on their spending.

In order to achieve that, they are to buy fewer and less expensive gifts, spend less on parties and decorations, as well as give up traveling plans. As far as promotions are concerned, holiday shoppers feel most attracted by free shipping when buying gifts online.

Over 80 percent are to make online purchases to benefit from free shipping, cash back and other promotions.

The study, which was commissioned by PayPal, also indicates a preference for ecologically-friendly products among online shoppers when it comes to buying gifts. Thus, almost a quarter of online shoppers have stated that they intend to purchase gift cards or green gifts including organic foods, eco-conscious clothing and recycled house wares.

College graduates feel most inclined to receive alternative gifts. 28 percent have expressed their preference for green items, 25 percent for electronic gift cards and 20 percent for donations to charity on their behalf. 73 percent of online shoppers have made plans to give to charity this season, over 60 percent in 2007. The study also indicates that one third of online buyers use PayPal when buying online and one in five buyers have made plans to do more online shopping in 2008 than they did in 2007.

PayPal's 2008 Holiday Survey was conducted by Ipsos.

In order to achieve that, they are to buy fewer and less expensive gifts, spend less on parties and decorations, as well as give up traveling plans. As far as promotions are concerned, holiday shoppers feel most attracted by free shipping when buying gifts online.

Over 80 percent are to make online purchases to benefit from free shipping, cash back and other promotions.

The study, which was commissioned by PayPal, also indicates a preference for ecologically-friendly products among online shoppers when it comes to buying gifts. Thus, almost a quarter of online shoppers have stated that they intend to purchase gift cards or green gifts including organic foods, eco-conscious clothing and recycled house wares.

College graduates feel most inclined to receive alternative gifts. 28 percent have expressed their preference for green items, 25 percent for electronic gift cards and 20 percent for donations to charity on their behalf. 73 percent of online shoppers have made plans to give to charity this season, over 60 percent in 2007. The study also indicates that one third of online buyers use PayPal when buying online and one in five buyers have made plans to do more online shopping in 2008 than they did in 2007.

PayPal's 2008 Holiday Survey was conducted by Ipsos.

Global PCI DSS Deadline Set by Visa

Visa Sets Global PCI DSS Deadlines

Data Security Compliance Requirements Aligned Across Visa Regions

San Francisco, CA, November 10, 2008

Visa Inc. (NYSE: V) today announced global mandates for compliance with the Payment Card Industry Data Security Standard (PCI DSS), creating a consistent framework for compliance among merchants, service providers and their agents.

The enhancements include a global set of requirements for merchants to validate their compliance with PCI DSS; and for the largest merchants, dates by which they must achieve validation. Deadlines are also set for large and mid-level merchants to demonstrate that they are not storing certain types of sensitive card data. Service provider levels and PCI DSS validation requirements have likewise been aligned under a global standard and compliance timeline. Compliance with PCI DSS will help protect businesses from financial and reputational harm that often results from cardholder data compromises. Visa data security compliance programs have provided compelling incentives for merchants and agents to properly secure cardholder data.

The new framework establishes the minimum requirements for Visa Inc. regions. As an independent company and licensee of Visa International for the business operations in European markets, Visa Europe's PCI DSS framework requires compliance validation and risk mitigation for Level 1 merchants; however the region will be adhering to a different timeline and process for executing compliance validation.

"Compliance with PCI DSS is vital to ensuring the integrity of the global payments system," said Eduardo Perez, head of global data security, Visa Inc. "Aligning compliance programs across the Visa regions is the latest step in our commitment to safeguarding cardholder data."

To read the entire Press Release, click here

AMEX now a Bank Holding Company

11/11/2008

The Federal Reserve said it rushed approval of American Express' application to convert to a bank holding company because of "emergency conditions" and the financial markets' "unusual and exigent circumstances."According to the Fed, AmexCo had $127bn in total assets but retail deposits of just $7.2bn – another sign that the financial crisis isprompting regulators to accept bank holding applications from companies with little retail banking presence.

Bank holding companies get access to low-cost Fed lending facilities but have to submit to the stricter regulation and capital requirements demanded by the regulators.

American Express had already operated a commercial bank and a savings bank supervised by federal regulators. But the bulk of its assets were not in those institutions. As a bank holding company, these assets are now under federal supervision, a move that expands the amount of financing it can request from the government. That means the bank could qualify for up to $3.6 billion of the Treasury Department’s money, instead of just a small portion.

“Given the continued volatility in the financial markets, we want to be best positioned to take advantage of the various programs the federal government has introduced or may introduce,” said Kenneth I. Chenault, the chairman and chief executive of American Express. “We will continue to build a larger deposit base to broaden our funding sources.”

Financial Times (11/11) New York Times 11/10

Talk About Swiping a PIN Pad

Skimming scam spreads from Calgary

Skimming scam spreads from Calgary

Calgary Herald

Published: Tuesday, November 11, 2008The same debit card skimming scam discovered in Calgary two months ago has turned up in Airdrie and Red Deer, and police fear other areas have been targeted, too.

Police say they have video footage of a thief stealing a debit card pin pad just before an Airdrie retailer closed for the night on Sept. 11. After compromising the pad with wireless transmitter technology overnight, it was slipped back in the morning.

The pad functions normally but transmits all data to the criminal, police say.

Police say they suspect two other businesses have been targeted.

One pin pad was found after becoming inoperative and returned for service. The other was discovered only after more than 120 debit cards were cloned and used to extract money from the victims' accounts.

A compromised pin pad results in an average of $100,000 in loss, police say.

"It is believed that there is a possibility that additional retailers in southern Alberta have had their debit card pin pads compromised as well and are just not aware of this attack as yet," said RCMP spokesman Sgt. Patrick Webb.

© The Calgary Herald 2008

Monday, November 10, 2008

Alternative Payments Continue Torrid Growth

Current Economic Climate Impacts Credit Card Usage for Online Purchases, Paving the Way for Alternative Methods During Holiday Shopping Season

Nearly One Third of Online Retail Transactions Expected to be Alternative Payments by 2013

SAN FRANCISCO, November 10, 2008 – Javelin Strategy & Research (www.javelinstrategy.com), the leading independent provider of quantitative and qualitative research focused exclusively on financial services, today announced release of its 2008 Online Retail Payments Forecast, which delves into the increasing appeal and growth of alternative payment methods and the impact it represents to banks and traditional card networks like Visa, MasterCard, American Express and Discover.

The study (www.javelinstrategy.com/2008OnlineRetailPaymentsForecast.html) finds that while online payments represents only 3.5% of total retail sales in 2008, consumers are steadily increasing adoption of alternative payment types, replacing transactions from the traditional, financial institution-controlled credit and debit cards.

“Although Javelin’s forecast predicts online debit and credit card usage will continue to dominate and grow,” said Javelin president and founder, James Van Dyke. “Alternative payment methods are becoming a preferred choice by many consumers shopping online and will continue to grow over the next five years, steadily increasing to one-third of the online retail transaction volume.”

Van Dyke adds, “During this year’s holiday shopping season we project $7.8 billion will come from alternative payments versus $35 billion from traditional online payment methods.

Forecasted Growth in Online Retail Transactions Through 2012

The overall projected growth for online payments is expected to reach $148 billion in 2008, climbing to $268 billion by 2013.

Editor's Note: According to the graph on the right, from Celent Analysis, it looks to me like PIN Debit for the Web has the highest value proposition for both Consumers and Merchants, which bodes well for HomeATM ePayment Solutions and other's who are looking to bring PIN debit to the Web...

The essential shift in growth rates during the five year period trends faster for alternatives, especially those that have built brand awareness with consumers, such as PayPal; as well as alternatives for traditional companies such as Stored Value.

Javelin’s study delves into all of the alternative payment companies and forecasts each payment category’s expected transaction volume. In addition to the established alternative payment companies, it highlights a new wave of emerging alternative payments firms, which may further erode traditional credit card usage online—yet actually preserve the role of financial institutions in payment transactions.

Financial Institutions and Payment Networks Should Embrace Alternative Payment

Well-branded alternative payments companies have benefited from the current economic pressures as consumers seek more cash-based solutions. The forecast demonstrates how the channel-shift toward alternatives impacts traditional financial institutions, suggesting they proactively develop an alternative payments strategy.

“Banks and traditional card brands that don’t want to risk erosion of online transaction volume should expand their own prepaid card product offerings, while partnering with alternative providers,” said Bruce Cundiff, Javelin’s director of payments research and consulting. “By integrating alternative payments, financial institutions will maintain their position and status as the ‘agent’ for online payments.”

Key Findings:

Alternative payments erode credit card usage more prevalently than debit card given the cash-based benefits of a debit transaction.

Credit card issuers can supplement slowing credit card volume with prepaid products.

Store-branded and private-label credit cards are projected to have solid growth, based on consumers migrating purchases from in-store to online.

Three emerging alternative payment methods—eBillme, NACHA SVP and Moneta Value— leverage familiar consumer processes and provide value to financial institutions by enabling FI control over the transaction.

With the acquisition of BillMeLater by eBay/PayPal, growth is expected for BillMeLater.

Mobile channel growth is key to Google’s outlook and brings wireless carriers into the payments space—potentially with solutions that preserve financial institutions’ role as the transaction ‘agent’.

Learn More About Javelin’s Online Retail Payments Forecast

Subscribers to Javelin’s payment’s research service automatically received this research report. Those interested in learning more about Javelin’s subscription and custom research services may call +1.610.450.5909, email sales@javelinstrategy.com. To request a copy of the research or to arrange an interview with James Van Dyke or Bruce Cundiff, please contact Kathleen McCabe at +1.925.225.9100 extension 15 or k.mccabe@javelinstrategy.com.

Editor's Note: According to the graph on the right, from Celent Analysis, it looks to me like PIN Debit for the Web has the highest value proposition for both Consumers and Merchants, which bodes well for HomeATM ePayment Solutions and other's who are looking to bring PIN debit to the Web...

The essential shift in growth rates during the five year period trends faster for alternatives, especially those that have built brand awareness with consumers, such as PayPal; as well as alternatives for traditional companies such as Stored Value.

Javelin’s study delves into all of the alternative payment companies and forecasts each payment category’s expected transaction volume. In addition to the established alternative payment companies, it highlights a new wave of emerging alternative payments firms, which may further erode traditional credit card usage online—yet actually preserve the role of financial institutions in payment transactions.

Financial Institutions and Payment Networks Should Embrace Alternative Payment

Well-branded alternative payments companies have benefited from the current economic pressures as consumers seek more cash-based solutions. The forecast demonstrates how the channel-shift toward alternatives impacts traditional financial institutions, suggesting they proactively develop an alternative payments strategy.

“Banks and traditional card brands that don’t want to risk erosion of online transaction volume should expand their own prepaid card product offerings, while partnering with alternative providers,” said Bruce Cundiff, Javelin’s director of payments research and consulting. “By integrating alternative payments, financial institutions will maintain their position and status as the ‘agent’ for online payments.”

Key Findings:

Alternative payments erode credit card usage more prevalently than debit card given the cash-based benefits of a debit transaction.

Credit card issuers can supplement slowing credit card volume with prepaid products.

Store-branded and private-label credit cards are projected to have solid growth, based on consumers migrating purchases from in-store to online.

Three emerging alternative payment methods—eBillme, NACHA SVP and Moneta Value— leverage familiar consumer processes and provide value to financial institutions by enabling FI control over the transaction.

With the acquisition of BillMeLater by eBay/PayPal, growth is expected for BillMeLater.

Mobile channel growth is key to Google’s outlook and brings wireless carriers into the payments space—potentially with solutions that preserve financial institutions’ role as the transaction ‘agent’.

Learn More About Javelin’s Online Retail Payments Forecast

Subscribers to Javelin’s payment’s research service automatically received this research report. Those interested in learning more about Javelin’s subscription and custom research services may call +1.610.450.5909, email sales@javelinstrategy.com. To request a copy of the research or to arrange an interview with James Van Dyke or Bruce Cundiff, please contact Kathleen McCabe at +1.925.225.9100 extension 15 or k.mccabe@javelinstrategy.com.

$1 Trillion Spent Online by B2C Consumers by 2012

2008 Global Broadband - M-Commerce, E-Commerce & E-Payments - Market Research Reports - Research and Markets

E-commerce is now an important part of the economy, particularly in the developed markets. While e-commerce is still in its infancy in many emerging markets, this is set to change in the coming years especially in China. In 2008 China now has the highest number of Internet users in the world, overtaking the USA. E-commerce growth in the USA remains strong however, with China also offering significant opportunities for those operating in the e-commerce space.

Key highlights:Worldwide the number of Internet users has now reached around 1.4 billion and billions will be spent by consumers during 2008 on online retail. While the economic slowdown will most likely curb e-commerce growth somewhat over the next couple of years, particularly spending on online advertising, there is evidence that so far the online retail market has remained steady due mostly to the lower prices offered via online shopping.

- By 2012 it is expected that more than 1 trillion will be spent online

by B2C consumers. B2B spending will exceed this considerably.- E-payment solutions are an important part of e-commerce transactions;

however security issues continue to tarnish the industry.- Asia

Pacific leads the world in terms of using mobile phones for m-payments,

accounting for around 85% of customers worldwide.- BuddeComm

estimates revenue from mobile content and services (excluding SMS),

accounts for around 7-10% of total mobile revenues worldwide. SMS

remains popular and accounts for a further 10% of total mobile data

revenues..- Online advertising growth is set to continue for the

next few years, but will slow slightly in the wake of the US financial

crisis. It is expected that online advertising will eventually account

for around 20% of all advertising spend in some markets.- Search

services are central to almost everything that users do online, and

this places leading search companies such as Google and Yahoo at an

advantage. In the emerging Chinese market, Baidu and Alibaba also have

a good foothold.- Google is still the most popular website

property worldwide; however individual countries and regions show

unique differences with many local sites remaining popular. Other web

properties proving popular across multiple markets include Yahoo,

Microsoft and Wikipedia sites, Apple Inc, eBay and Amazon.

Internet banking has slowly become more popular around the world, with 30% or more of Internet users utilising such services in some markets. However many online banking websites have at least one potential design weakness that could leave users vulnerable to cyber attacks. Improved bank security measures over the last couple of years, such as the introduction of home chip and pin devices is helping to combat this issue.

In the next few years the total entertainment and publishing industry (including offline and online) is expected to be worth more than $2 trillion – driven in particular by a wave of growth in online video games, gambling, music, social networking/UGC, and online video. In recent times sales of digital music, mostly via the Internet, have increased by more that 30%; in contrast sales of CD and DVDs continue to decline. Online video consumption is also beginning to produce promising results and advertisers have begun to seriously take note. Pay-to-own downloading is particularly popular and new business models in this area are expected to emerge over the next few years. Travel and adult content services are also popular with more growth expected ahead.

Mobile commerce is potentially important for a wide range of industries, including telecommunications, IT, finance, retail and the media, as well as for end-users. It will work best in those areas where it can emphasise the core virtue of mobile networks – convenience. However while there are good applications, the technologies and business models to date have not been well suited to mass market applications. The regulatory environment has also held this market up. This is beginning to change as banks and merchants collaborate with mobile operators. Applications around contactless cards using Near Field Communications are also being developed around the world. Focus has also turned to the developing markets, where mobile phones are being viewed as an opportunity to reach the masses that would not otherwise use m-payment or m-banking services.

*Data in this report is the latest available at the time of preparation and may not be for the current year*

ATM's To Be Used for P2P Money Transfers?

Related: Privier Press Release: Privier Develops ATMSend

A new way to transfer cash

Bank ATMs soon may be used for sending cash person-to-person

By Gail Liberman and Alan Lavine Last update: 7:57 p.m. EST Nov. 10, 2008 PALM BEACH GARDENS, Fla. (MarketWatch) --If you're without a bank account, you soon could have a low-cost way of sending cash to others -- using your cell phone and a bank ATM.

Amid criticism that banks aren't doing enough to attract those who lack bank accounts, a Charlotte-based company, Privier Inc., is courting financial institutions to provide this service.

Privier's patented "ATMSend" would let the so-called un-banked transfer cash without requiring the sender or recipient to have a bank ATM card or bank account. The system would use bank ATMs that permit cash deposits, said Charles Polanco, chief executive of Privier.

Western Union Co. in Englewood, CO., and MoneyGram International in Minneapolis, currently dominate the money transfer business. Combined, the two companies have 22% of the market, according to a report in June by Marketdata, a Tampa, Fla. market research publisher. However, new competition is rapidly emerging from Visa, MasterCard, Wal-Mart -- and the latest mobile technology allowing for financial transactions using cell phones.

Privier would equip screens of participating bank ATMs with icons reading "Send Cash" and "Pickup Cash." A cash sender and recipient would press appropriate buttons to automatically activate the ATM for an "ATMSend" transaction, Polanco said. Each bank would determine limits regarding how much cash could be transferred.

The sender first would have to register a cell phone through a participating bank either online or via telephone, entering a name, address, birth date, Social Security number and cell phone number. Privier would verify the user's identity and check information against the Office of Foreign Assets Control list of terrorists.

At a participating bank ATM, the sender could then click "Send Cash" and enter the cell phone number. A 10-digit withdrawal number automatically would be text-messaged to the cell phone number provided. The sender could follow prompts at the ATM to enter cash into the machine and provide the recipient with the authorization code along with the amount sent. With that information, the recipient could obtain the cash at an ATM within the participating bank's network.

All funds must be picked up at once, and if funds go unclaimed, senders would be notified to pick up the funds at an ATM location after 30 days.

Many money-transfer options

Mobile finance that uses cell phones for financial transactions is a growing technological area because 80% of the global population is covered by a cell phone network, Marketdata reports.

Polanco pointed to data from the Chicago-based Center for Financial Services Innovation indicating that 106 million persons in the U.S. lack a bank account. More than half, he said, have Social Security numbers; however many are distrustful of banks.

Meanwhile, the money transfer remittance marketplace is a $6.1 billion industry, slated to grow 8% in 2008, Marketdata said. Large U.S. banks already in the money transfer business include Bank of America Corp, Citigroup Inc., Wells Fargo, BB&T Corp and U.S. Bancorp (USB:

USB the report said.

These programs often are limited to specific countries. Bank of America offers free transfers for people who have a bank account.

Western Union Co. has been piloting mobile money transfer through arrangements with two Philippines-based wireless services operators, Globe Telecom and Smart Communications. Right now, it costs as little as $2.56 to send up to $100 for a mobile transfer from Hawaii to the Philippines, said Kristin Kelly, a spokeswoman with Western Union. Cash also may be sent to the Philippines from the United Arab Emirates, Singapore and Hong Kong from Western Union locations.

In the U.S., Western Union recently wrapped up another pilot with a prepaid phone through Trumpet Mobile, a brand of Affinity Mobile in Dallas. People who bought a prepaid phone at Radio Shack stores got a free prepaid card. They were able to add funds to the card by giving cash to an agent at certain locations, like Western Union offices. The card could be used like a credit card or linked via the cell phone to Western Union's account data base. The Philippines pilot will be expanded to other markets, Kelly said. The Trumpet Mobile pilot was successful, and currently is being evaluated, she said.

Through the U.S. Postal Service's "Dinero Seguro" program, you can wire money from nearly 3,000 U.S. post offices to up to 10 countries. You can send up to $2,000 in 15 minutes to arrive at a specific participating bank branch. Government-issued identification is required for transfers over $800, and fees range from $10 to $20. However, domestic wire transfers are not available.

Wal-Mart Stores Inc. touts low fees for money transfers in partnership with MoneyGram International. Domestic transfers at Wal-Mart stores cost $11.46 for amounts up to $200 and international transfers cost $9.46 for amounts up to $1,000.

Spouses Gail Liberman and Alan Lavine are syndicated columnists. Their latest book is "Quick Steps to Financial Stability" (Que/Penguin). You can contact them at www.moneycouple.com.

Online Shopping Growth Stunted

by Sarah Mahoney, Monday, Nov 10, 2008 7:00 AM ETIt looks like the sluggish economy has finally gotten its hooks into Internet sales.

The growth in online shopping hasn't just slowed, "it's fallen off a cliff," says Gian Fulgoni, chairman of comScore, which is predicting that e-commerce sales will grow between 6% and 10% this holiday season. And while any growth at all might sound like a dream come true to suffering brick-and-mortar retailers, it's shockingly low compared to recent years.

Year-to-date, comScore says, online sales have grown 10% to $158 billion--compared to 17% last year, 20% in 2006, and 22% in 2005. Just this year, it has plunged from 19% in the first quarter, 13% in the second, and 9% in the third. Excluding travel, the drop is even steeper, falling to just 5% in September.

"E-commerce has emerged as the earliest warning signal that there's a problem with disposable income," he says, and while national retail figures show steady gains, that is due primarily to inflation in food and gas--"neither of which you can buy online. This price inflation has just sucked all the air out of disposable income, and we're seeing it most in people earning less than $100,000," he says. "It's not a pretty picture." Indeed, people earning less than $100,000 increased their online spending just 3% in the third quarter.

On the flip side, among consumers who earn more than $100,000, "the market meltdown has simply hammered their confidence. They're on pins and needles," he says. About 85% of those in this higher bracket agreed with the somewhat apocalyptic statement "I am more afraid about the economic future than ever before." This group is driving the increase to coupon sites, with 37% more of these shoppers using them than before.

And some categories are actually registering sales declines. Hardest-hit is the apparel, shoe and accessory category, which saw a decline of 3% in online sales in the third quarter; books and magazines, with a decline of 17%; and music, movies and videos, with a drop of 29%.

ComScore's predictions are considerably more grim than what online retailers predict themselves. A study released recently by Shop.org, a division of the National Retail Federation, reports that 56.1% of online retailers expect their holiday sales to increase at least 15% compared to last year (that compares to 77.5% last year.) "Online retailers are resilient, but not immune, to the challenges of this holiday season," the group says in its results.

Sarah Mahoney can be reached at sarah@mediapost.com

On Payments and Financial Patents

Payments Industry Regulatory Compliance: Payments Industry "Business Process" Patents - A Dent in the Holy Grail?

On October 30, 2008 the United States Court of Appeals for the Federal Circuit decided In re: Bilski, __F.3rd__ (Fed. Cir. 2008) (in banc), a decision that will likely reverberate widely in the payments and financial industry. With this decision the Federal Circuit, the federal court of appeals with jurisdiction for patent matters, snugged up the standards for patent eligibility of business processes and methods that had been loosened by its 1998 decision in State Street Bank & Trust vs. Signature Financial Corp.

Not all original inventions, discoveries or bright ideas are eligible for patent protection. In particular, abstract ideas, mental processes or fundamental principles of nature standing alone cannot be patented, as these are the foundations of civilization and progress, and belong to no one. An invention that utilizes one of these abstract ideas or principles to create a useful application in the world we live in can be patented, though, assuming it is novel and non-obvious. The maintenance and application of this distinction has bedeviled the Patent and Trademark Office, the courts and patent attorneys (not to mention us civilians) in recent years.

In the State Street case, the Federal Circuit upheld a patent on a software-implemented method of pooling, processing and accounting centrally for the assets of multiple mutual funds (a so-called "hub and spoke" configuration). It overturned a lower court decision finding the patent invalid on the then-prevalent view of software as a math-like algorithm tantamount to abstract ideas. The lower court had found that the mere processing of numbers into another form involved no physical transformation and was thus not a patentable process. The Federal Circuit in State Street created a new standard for the patent eligibility of software, from causing a physical transformation to producing "useful, tangible and concrete results". The Federal Circuit also made it clear that there was no per se exclusion from patent eligibility of business processes.The State Street decision is viewed by some as having opened the door to a flood of business process and software patent applications and granted patents in the last decade , although to some degree the decision merely reflected and justified what had already been occurring at the Patent Office. State Street was decided during the dotcom boom in the late 1990's, and many patent applications during that period were for Internet-based processes, many, but not all, of them marketing-related. A particularly infamous patent was issued in 1999 to Amazon for a "one-click" on-line ordering and payment process. This is not the place to catalog the variety of types of business processes for which patent protection has been sought and granted, but the point is that seeking patent protection for business process and method became a key focus of many start-up and established businesses in and after the late 1990's. At the same time critics worried that the liberal standards for obtaining business process patents were stifling creativity and innovation, and requiring allocation of attention and resources to patent matters (offensive and defensive) that were better spent by businesses on developing and marketing products and services.

In the ten years since State Street was decided the Patent Office has struggled to find the limits of patent eligibility of business processes and software. Many of the patents that have been granted contained a technological component and thus could satisfy even pre-State Street standards, but the line was murky for many others. During the time I was responsible for the Visa patent program (2000-2005) I do not recall any instances where patent counsel felt an "invention", usually business process-based, could not be patented. Obviously this was a good time for the patent bar.

The Federal Circuit apparently was having second thoughts itself about the effects of its decision in State Street when it decided to rehear en banc an appeal from the decision of the Patent Board of Appeals and Interferences rejecting as patent ineligible the claims of one Bernie Bilski (Ex Parte Bilski (BPAI 2006)). Bilski involved patent claims for a system of hedging against bad weather for a distributor of commodities like grains, essentially consisting of contracting in advance a fixed price from its suppliers and a fixed price to its buyers. There was no technological component to the process, which could be performed entirely in the mind. Although these claims probably failed even the State Street test requiring a "tangible and concrete result", the Federal Circuit took the case as a vehicle to re-examine the standard of patent eligibility created in State Street, and ultimately rejected that standard in favor of the more restrictive standard State Street had replaced:

"A claimed process is surely patent-eligible under § 101 if: (1) it is tied to a particular machine or apparatus, or (2) it transforms a particular article into a different state or thing."

In other words, there must be a central physical component to a business method or software claim for it to qualify for patent protection. The meaning of this in the context of the transformative test in (2) above is that for software or process to be eligible for patent protection it must transform physical objects or representations of them into something else. It is hard to imagine an invention in the financial or payments industries being able to meet that test, and the key to patent eligibility after In re: Bilski will likely have to be meeting the "particular machine or apparatus" test in (1) above. Unfortunately, In re: Bilski provides no guidance in that area, with the Federal Circuit expressly deferring any guidance as to how that test can be satisfied to a future, more appropriate case. As one bit of clarification, though, the Patent Board of Appeals and Interferences has already held that "[a] general purpose computer is not a particular machine, and thus innovative software processes are unpatentable if they are tied only to a general purpose computer." See, for instance, Ex parte Langemyr (May 28, 2008) and Ex parte Wasynczuk (June 2, 2008).

The ultimate impact of In re: Bilski on the future of patents in the financial and payments industries is not clear yet, but it is important that the decision did not reject the patentability of business processes or software altogether. Although the decision is likely to slow the filing of new applications in these industries, there will likely still be many patent applications filed seeking to test the limits of the "particular machine or apparatus" test. Another consequence of the decision is to call into question the validity of those patents already granted under the rejected State Street test, requiring holders of these patents to review the claims under the In re: Bilski test and perhaps seek to correct any problems by adding claims more likely to survive a Bilski review through continuation or reissue proceedings.

In the long run, if patents cease to be the Holy Grail in the financial and payment industries, that may not be a bad thing. A patent is no substitute for being first to market with a well-executed, profitable business model. A strong patent can buttress a business position, but if seeking and waiting for one hinders being first to market it can hurt more than help.

Online Card Fraud Doubles in Japan from '04

Experts have also criticized businesses and the government for poor credit card security practices, pointing out that a transaction will be accepted on some systems even if the cardholder's name is wrong, as long as there is a correct card number and expiry date.

The study, which covered six major domestic credit card companies, shows that fraud has risen over the past few years, reaching 311 million yen in fiscal 2004 and 454 million the following year.

Internet shopping has shot up over the last 10 years -- reaching 4.391 trillion yen in 2006, compared to 62.5 billion yen in 1998 -- and around half of all transactions are now completed by credit card.

However, credit card-related crime is also rising.

During March 2005, credit card information on 698 people was stolen from a Yokohama gas stand, with those of 56 of the victims used for illicit purchases on the Internet. In another incident in Okayama Prefecture in June 2006, a gas stand worker stole credit card information from customers and used it to charge his e-money account on his mobile phone to the tune of 64,000 yen.

At the other end of the scale, credit card information on 40 million people, including those of 77,000 Japanese nationals, was lost in June 2005 after a U.S. data processing company server was hacked. Damage caused by subsequent fraudulent use is somewhere around 130 million yen, which is borne by the credit card company.

In order to improve credit card security, card companies are pushing a voluntary password system called 3D Secure. However, uptake by both consumers (4.7 percent, as of May 2006) and stores has been slow.

A spokesman from METI's Consumer Credit Division said: "3D Secure has to catch on. It shouldn't affect convenience and discourage consumers from using credit cards. But even when taking the damage incurred into account, we've had to leave uptake by businesses on a voluntary basis, since the time isn't ripe for drawing up a legal framework."

Click here for the original Japanese story

Subscribe to:

Posts (Atom)