Complete item: http://www.theregister.co.uk/2009/04/22/bandesco_cache_poisoning_attack/

One of Brazil's biggest banks has suffered an attack that redirected its customers to fraudulent websites that attempted to steal passwords and install malware, according to an unconfirmed report.

According to this Google translation of an article penned in Portuguese, the redirection of Bradesco was the result of what's known as a cache poisoning attack on Brazilian internet service provider NET Virtua.

DNS cache poisoning attacks exploit weaknesses in the internet's domain name system. ISPs that haven't patched their systems against the vulnerabilities are susceptible to attacks that replace the legitimate IP address of a given website with a fraudulent number. End users who rely on the lookup service are then taken to malicious websites even though they typed the correct domain name into their browser.

"That's pretty serious when you're talking about a banking organization," said Paul Ferguson, a security researcher with anti-virus provider Trend Micro. "If people are trying to log in to their account and they get rejected, they'll try again and again with the same user name and password."DNS cache poisoning has been around since the mid 1990s, when researchers discovered that DNS resolvers could be flooded with spoofed IP addresses for sensitive websites. The servers store the incorrect information for hours or days at a time, so the attack has the potential to send large numbers of end users to fraudulent websites that install malware or masquerade as a bank or other trusted destination and steal sensitive account information.

In 1998, Eugene E. Kashpureff admitted to federal US authorities that on two occasions the previous year he used cache poisoning to divert traffic intended for InterNIC to AlterNIC, a competing domain name registration site that he owned.

Makers of DNS software were largely able to prevent the attacks by adding pseudo-random transaction ID numbers to lookup requests that must be included in any responses. Then, last year, IOActive researcher Dan Kaminsky revealed a new way to poison DNS caches, touching off a mad scramble by the world's ISPs to fix the vulnerability before it was exploited.

The article from Globo.com cited a Bradesco representative who said that about 1 percent of the bank's customers were affected by the attack. It went on to suggest that customers who were paying attention would have noticed Bradesco's secure sockets layer certificate generated an error when they were redirected to the fraudulent login page.

Interestingly, it also said that a domain used for Google Adsense was redirected to a site that used malicious Javascript to install malware redirected machines. The attacks have since been resolved, the article stated.

It's still not clear exactly how the caches were tainted. Representatives for the ISP and the bank hadn't responded to requests for comment at time of publication.

For more details :

http://translate.google.com/translate?prev=hp&hl=en&js=n&u=http%3A%2F%2Fg1.globo.com/Noticias/Tecnologia/0,

,MUL1088103-6174,00-ATAQUE+LEVA+CLIENTES+DO+VIRTUA+A+SITE+CLONADO+DE+BANCO.html

Back in 2002, a company called ATMDirect was hyping their software based Internet PIN Debit platform...but nobody listened. Eventually they went bankrupt and Pay By Touch bought their assets out of bankruptcy.

Back in 2002, a company called ATMDirect was hyping their software based Internet PIN Debit platform...but nobody listened. Eventually they went bankrupt and Pay By Touch bought their assets out of bankruptcy.

Consumers in Belgium apparently feel least anxious about online security than people in any other European country.

Consumers in Belgium apparently feel least anxious about online security than people in any other European country.

According to the survey, 69% of UK consumers are now concerned about computer security and 65% are worried about their safety and security when shopping or banking online.

According to the survey, 69% of UK consumers are now concerned about computer security and 65% are worried about their safety and security when shopping or banking online.

Research shows that most online banking sites have inbuilt flaws which could potentially put valuable customer data into the wrong hands.

Research shows that most online banking sites have inbuilt flaws which could potentially put valuable customer data into the wrong hands.

Will 2FA use transcend online banking? : News : Security - ZDNet Asia

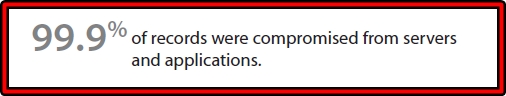

Will 2FA use transcend online banking? : News : Security - ZDNet Asia n Business data of 285 million compromised records from 90 confirmed breaches.

n Business data of 285 million compromised records from 90 confirmed breaches.