Other online gambling Web sites continue to be stifled under UIGEA

By Nadav S | May 07, 2009

Althoughthe terms of the 2006 Unlawful Internet Gambling Enforcement Act meanyou won't see advertisements for online gambling sites in the US, horseracing betting sites are still getting a free ride if a recent ad onESPN is any indication.

Youbet.com, a US-owned, based andlicensed operation, has been running ads recently on the US's mostpopular sports television channel and Website.

Placing ads onthe Connecticut-based cable television network exposes the Website tomillions of people, including minors, a right seemingly deprived toother online gambling sites.

This particular ad tells viewers to "sign up and get your first $25 free!" before jumping to the slogan "Youbet.com! You in?"

The advertisement includes a link to the Website as well a phone number to call to place bets.

Youbet.comis only open to legal residents of the US living in 13 specific stateslisted on its Website. The states include Nevada, New Jersey andArizona.

According to its Website, Youbet.com Inc. is a publiclytraded company (NASDAQ: UBET) that is US based, US licensed and in fullcompliance with all applicable state and federal laws.

It accepts wagers around-the-clock on races from over 150 racetracks in the United States and abroad.

Thursday, May 7, 2009

YouBet.com Runs Ad on ESPN

Visa Debit Commercial: Why Bother Going to an ATM?

Visa has launched a new television advertising spot in India entitled “Why bother going to the ATM?”, reflecting the company’s focus to increase cardholder awareness for using Visa Debit cards at point-of-sale locations.

FOR IMMEDIATE RELEASE

PRLog (Press Release) – May 07, 2009 – Bangalore, Visa, the world's largest retail electronic payments network, has launched a new television advertising spot in India entitled “Why bother going to the ATM?”, reflecting the company’s focus to increase cardholder awareness for using Visa Debit cards at point-of-sale locations.

The new commercial highlights the “buy now, pay now” feature of Visa Debit cards which provides cardholders direct access to their nominated bank account to make purchases wherever Visa is accepted.

Uttam Nayak, country manager, South Asia, Visa said, “Our message is aimed at the millions of Indian consumers already carrying a Visa Debit card in their wallet or pocket. We are using this campaign to remind cardholders that there is no need to go to the ATM or spend time queuing in lines to withdraw cash. Instead, all they need to do is use their Visa Debit card to pay for everyday purchases including for petrol, groceries, bill payments and dining out at those merchant outlets displaying the Visa acceptance sign.”

Consumers can use their Visa Debit cards at more than 30 million merchant locations at home and abroad, as well as make online and phone purchases. A Visa Debit card provides cardholders with a safe and convenient way to pay for goods and services at point-of-sale, without the risk associated with carrying cash. Cardholders can also access funds from their bank account at over 1.4 million ATMs worldwide.

The “Why bother going to the ATM?” advertising made its debut on 1 May with a television commercial (TVC) featuring established Bollywood actor Vinay Pathak. The effort will be supported through various channels such as outdoor signage, print, radio and cinema as well as consumer promotion activities. The TVC will be aired in Hindi and English, plus six local languages.

The TVC portrays Vinay as an autorickshaw driver who gives his passenger a humorous lesson about the card in his pocket and how going direct is better. The screenplay highlights the fact that the card the passenger is carrying in his pocket is actually a Visa Debit card that can be used at point-of-sale locations such as the supermarket, cinema or restaurant.

In March 2009, Visa launched the ‘More People around the World Go with Visa’ campaign in India, a locally adapted global campaign which connected with Indians through emotional touch points such as cricket, festivals, marriage and dining.

“This new commercial reinforces Visa’s call to action through an invitation to cardholders to move spending from cash to electronic payments by using their Visa Debit card. This is in line with our vision of better money for better living especially in challenging economic times when consumers are focused on better ways to manage their money,” Mr. Nayak said.

# # #

About Visa Inc.

Visa Inc. operates the world's largest retail electronic payments network providing processing services and payment product platforms. This includes consumer credit, debit, prepaid and commercial payments, which are offered under the Visa, Visa Electron, Interlink and PLUS brands. Visa enjoys unsurpassed acceptance around the world, and Visa/PLUS is one of the world's largest global ATM networks, offering cash access in local currency in more than 170 countries. For more information, visit www.corporate.visa.com.

Because There's No Patch for Human Stupidity

Complete item: http://www.finextra.com/fullstory.asp?id=20007

Description:

An intruder has gained access to the offices of a FTSE-listed financial services firm and duped staff into handing over sensitive information, including staff usernames and passwords, during a social engineering exercise.

Siemens Enterprise Communications, which conducted the exercise, says organizations now spend fortunes to protect confidential information from cybercriminals who try to hack into their IT systems. Yet they are still at risk through simple social engineering techniques where staff are manipulated into handing over information.

At the financial firm the intruder, a Siemens consultant, managed to enter the office without being challenged by security staff before basing himself in a third floor meeting room, where he worked for several days.

The intruder gained access to the company's data room, IT, and telecoms network. He then used the internal telephone system to call employees, claiming to be from the IT department, backed up by the caller ID, and requested information.

Of twenty users targeted, seventeen supplied their usernames and passwords giving the intruder easy access to confidential electronic data.

During the week-long exercise at the firm, Siemans says the consultant befriended a number of employees and was even on first name terms with the foyer security guard. On two separate occasions, the consultant managed to escort a second Siemens staffer into the building who was able to perform further analysis of the company's IT network.

Colin Greenlees, security and counter fraud consultant, Siemens Enterprise Communication, says: "Social engineering is principally concerned with manipulating people into performing actions or divulging confidential information in order to access electronic or physical data. Hi-tech protection systems are completely ineffectual against such attacks, and most employees are utterly unaware that they are being manipulated."

Vuja Day

I'm having a Vuja Day. That's when you get the feeling that this never happened before...and then it's gone...!

In a press release Acculynk announced they signed up 2Checkout.

I'd started to write a post about that ...but then realized that I had already done one on 2Checkout...."2Plus years ago!" (so I was able to save some time and simply repost the one I had already done...see below) In the meantime, my Vuja Day just turned out to be Deja Vu...all over again.

Monday, April 09, 2007

Pay By Touch PIN-Debit Solution Adopted by 2Checkout

Leading E-Commerce Platform Adopts Internet's First Software-Only PIN-Debit Payment Service

"Our focus is on providinga great customer shopping experience, including giving consumers avariety of ways to pay," said Kristin Dach, Chief Financial Officer for2Checkout.com (www.2checkout.com).

"Manypeople are seeking a more secure way to pay online or simply prefer toshop with their PIN-debit cards. We see Internet PIN-debit as anotherway to provide superior service to these customers while encouragingmore consumers to shop with us."

"Manypeople are seeking a more secure way to pay online or simply prefer toshop with their PIN-debit cards. We see Internet PIN-debit as anotherway to provide superior service to these customers while encouragingmore consumers to shop with us."PIN Debit has been in widespreaduse for over 20 years and remains one of the most popular, fastestgrowing and most secure payment methods in the world. On the Internet,the ATM Direct PIN-debit service (www.atmdirect.com)provides an ideal payment alternative for consumers that prefer debit,have limited credit or are seeking a more secure way to pay over theInternet.

"Consumersrecognize PIN-debit as a very secure form of payment, and the onlinePIN-debit experience is the same," said Robert Ziegler, General Managerfor ATM Direct at Pay By Touch. "ATM Direct does not change the flow ofthe merchant site or redirect the shopper to a new page. Merchants havecontrol over how they present the PIN-debit option, which can be aseasy as 'Debit or Credit.' Shoppers simply enter their card number,followed by their 4 digit PIN. It's fast, easy and can help lower therisk of shopping cart abandonment."

Like PIN-debit paymentsin the brick-and-mortar world, Internet PIN-Debit transactions areprocessed across the EFT networks directly with the consumer's bank,allowing real-time, guaranteed payments to Internet retailers at lowercost than credit card or signature debit card transactions over theInternet.

Like PIN-debit paymentsin the brick-and-mortar world, Internet PIN-Debit transactions areprocessed across the EFT networks directly with the consumer's bank,allowing real-time, guaranteed payments to Internet retailers at lowercost than credit card or signature debit card transactions over theInternet.The ATM Direct service is the Internet's onlysoftware-only PIN-debit solution which allows for rapid, no-costdistribution. By adhering to PIN-debit industry standards, the ATMDirect service also enables networks, banks and card issuers thatalready accept PIN-debit to accept Internet PIN-debit transactions withfew to no changes to their infrastructure.

About 2Checkout™

2Checkout.com,Inc. (2CO) is an online reseller for over 300,000 tangible or digitalproducts and services. Established in 1999 and headquartered inColumbus, Ohio, 2Checkout.com is an e-commerce solution that deals inUSD and multiple foreign currencies. The 2CO model combines multiplepayment channels, fraud detection, data security, customer service, PCIcompliance, co-branding and dependability. For additional information,visit http://www.2checkout.com.

About ATM Direct, a Division of Pay By Touch

ATMDirect, a division of Pay By Touch, provides innovative and securepayment and authentication services to the Internet economy. The ATMDirect™ merchant services deliver the industry’s first software-only,regulatory compliant, Internet PIN-debit payment service. Foradditional information, visit www.atmdirect.com

About Pay By Touch™

PayBy Touch (www.paybytouch.com) is the global leader in biometricauthentication, personalized marketing and payment solutions. Already,more than 3.6 million consumers are using Pay By Touch services toidentify themselves, make purchases, cash checks and get personalizedsavings with the touch of a finger. Pay By Touch services are free forconsumers to use and available in more than 3,000 retail locationsacross 44 states, the UK and Singapore. Pay By Touch also providesrobust data management and payment processing solutions for ACH(electronic checking), card-present and card-not-present debit andcredit transactions for retail clients. Founded in 2002 andheadquartered in San Francisco, Pay By Touch employs 800 professionalsand holds more than 60 patents worldwide on secure, convenient andcost-effective transaction solutions.

Pay By Touch

- Fountain Hills, Arizona, United States

Fed Rejects Common Sense - Retroactive Rate Increase Cool with Them

WASHINGTON (Reuters) - The U.S. Federal Reserve rejected a request to force credit card companies to immediately halt retroactive interest-rate increases on existing balances, Democratic Senator Charles Schumer said on Tuesday.

Schumer and Christopher Dodd, who chairs the Senate Banking Committee, asked the Fed last month to use its emergency powers for rescuing banks to also help credit card consumers being slapped with unexpected rate increases.

"The Federal Reserve's failure to protect consumers from these outrageous rate increases is unconscionable," Schumer said.

Editor's Thoughts: So let's say you decide you "may" want to purchase a 52" LCD HDTV. Part of the decision process to "buy" is that you have a 5.9% rate on one of your credit cards. So you make the purchase. Then, the credit card company hikes your rate to 19%. If it was 19% at the time of the purchase, you wouldn't have made the move. It was BECAUSE you had a 5.9% rate that you did. It only makes complete and logical sense that retroactive rate increases are ridiculous.

What would happen if you decided to buy a $35,000 car because they advertised 0% financing and 6 months into the purchase, they changed the rate to 19%? What's the difference? Why did the Federal Reserve reject this request? It doesn't seem to make sense.

Western Union to Acquire Custom House

WesternUnion has announced a definitive agreement to acquire Canada-basedCustom House, Ltd., a provider of business-to-business internationalpayment solutions for small and medium enterprises. The US $370 millioncash transaction is expected to close in the third quarter 2009,subject to regulatory approvals and customary closing conditions.

The international SME payments market is a large,growing and highly fragmented category. Today, Custom House is on planto generate US $100 million in annualized revenue, primarily fromsenders in seven countries including Canada, the United States, theUnited Kingdom, Italy, Australia, Singapore and New Zealand. Thecompany has built a sizable client base, significant internationalpayment capabilities, a strong network of banking partners and scalableoperations that are poised to capitalize on this opportunity.

CustomHouse’s multi-channel payment solutions include their online platform,which provides reliable web-based payment capabilities to over 120countries worldwide. These strengths will be enhanced by WesternUnion’s globally recognized brand, international footprint andfinancial strength.

Christina Gold, president and chief executive officer ofWestern Union, stated, “Custom House is a dynamic business and has asignificant customer base in the cross-border payments market, whichgenerates strong margins and cash flow. Western Union intends to growthis business by attracting new customers and entering newgeographies.”

Strategic Rationale

The acquisition of Custom House supports Western Union’s strategic plan by:Peter Gustavson, Custom Housechairman and founder, stated, “We are extraordinarily proud of what theCustom House team has accomplished as an independent company and areexcited about the increased potential that will come from leveragingour collective resources.”

- Entering a new growth market and diversifying its product portfolio

- Furthering Western Union’s presence in the SME payment market

- Expanding its customer base

- Building a global line of business

- Establishing strong account-to-account transfer capabilitiesthat complement Western Union’s existing cash-to-cash andaccount-to-cash expertise

Currently owned by Peter Gustavson and the Boston-based privateequity firm Great Hill Partners, Custom House will become part of theWestern Union Global Payments segment (formerly theconsumer-to-business segment) on completion of the transaction, andcontinue to operate under its existing management team in Canada. Foreach of the past nine years, Custom House has been voted one ofCanada’s 50 Best Managed Companies.

Ranjana Clark, executive vice president of Global Payments andGlobal Strategy, stated, “Custom House is a highly complementarybusiness with a proven operating model, seasoned management anddifferentiating technology. Custom House President and CEO Peter Ciceriand his team are known for providing clients with speed, accuracy andworld-class customer service. We look forward to working closely withCustom House as we continue to grow this dynamic business.”

Custom House has been growing revenue at a 20% CAGR over thepast three years. The Victoria-based company has a diverseinternational client base of nearly 40,000 customers with an averageprincipal per transaction of approximately US$25,000. With a strongteam of 630 employees worldwide, Custom House’s multi-channel deliveryand recurring transaction-based business model has significantoperating leverage.

Snapshots Added to PIN Payments Blog

Introducing Snap Shots from Snap.com

I just installed a nice little tool on this site called Snap Shots that enhances links with visual previews of the destination site. Sometimes Snap Shots bring you the information you need, without your having to leave the site, while other times it lets you "look ahead," before deciding if you want to follow a link or not.Should you decide this is not for you, just click the Options icon in the upper right corner of the Snap Shot and opt-out.

Wednesday, May 6, 2009

China UnionPay Expanding Online Payments

China UnionPay targets online payments market expansion Tuesday 5 May 2009 | 11:28 AM CET

Chinese credit card organization and interbank operator China UnionPay (CUP) aims to provide its online payment services to companies which are active in the Chinese e-commerce sector, Interfax China reports.

For this purpose, ChinaPay E-payment Service, CUP's online payments division, has become involved in negotiations for partnership purposes with various Chinese online retailers, including online book retailer Dangdang.com, B2C e-commerce company 360buy.com and Joyo Amazon. Furthermore, CUP has opened branches across the region and has signed agreements with banks across 61 countries and regions in order to tap into the online payments market.

According to Chinese consulting firm iResearch Consulting Group, revenues generated by internet payment transactions in China in Q1 2009 have reached USD 17.26 billion, growing 146.9 percent over Q1 2008.

Haggleocity.com For Sale :-)

NetHaggler Will Barter With Online Retailers For You

Leena Rao - TechCrunch.com

With retail spending at all-time lows thanks to the current recession, stores are looking for ways to provide deals, sales and discounts for consumers. Some stores are even letting consumers haggle for prices. NetHaggler is hoping to woo both consumers and online retailers by providing a service that lets users track and negotiate prices online. Free for consumers, NetHaggler has enlisted retailers to participate in its service through affiliate marketing services, like LinkShare.

After installing a simple and secure bookmarklet (called the "Hagglet"), users can click on the link on the link in your bookmarks bar and draw a box with a cropping tool around any product that is from an affiliate NetHaggler Store. This lets NetHaggler capture and store the product and price information so the site can work its negotiation magic. The site will then let you choose whether you want to Tag, Nag or Haggle a product.

Tagging an item lets you enter a specific price and then get updates via email with price reductions that occur over the next few weeks or months. Nagging, which is NetHaggler's flagship offering, enlists NetHaggler to determine whether consumers are eligible for an immediate discount on the list price. Consumers can submit a price that they are willing to pay and then NetHaggler will return with an yes, no or counteroffer from the retailer. NetHaggler's founder, Satya Iluri, says that the site employs an algorithm to determine how much of a discount the retailer is willing to negotiate (if any) and also takes into account the consumers behavior in the site.

Continue Reading at Washington Post

© 2009 TechCrunch

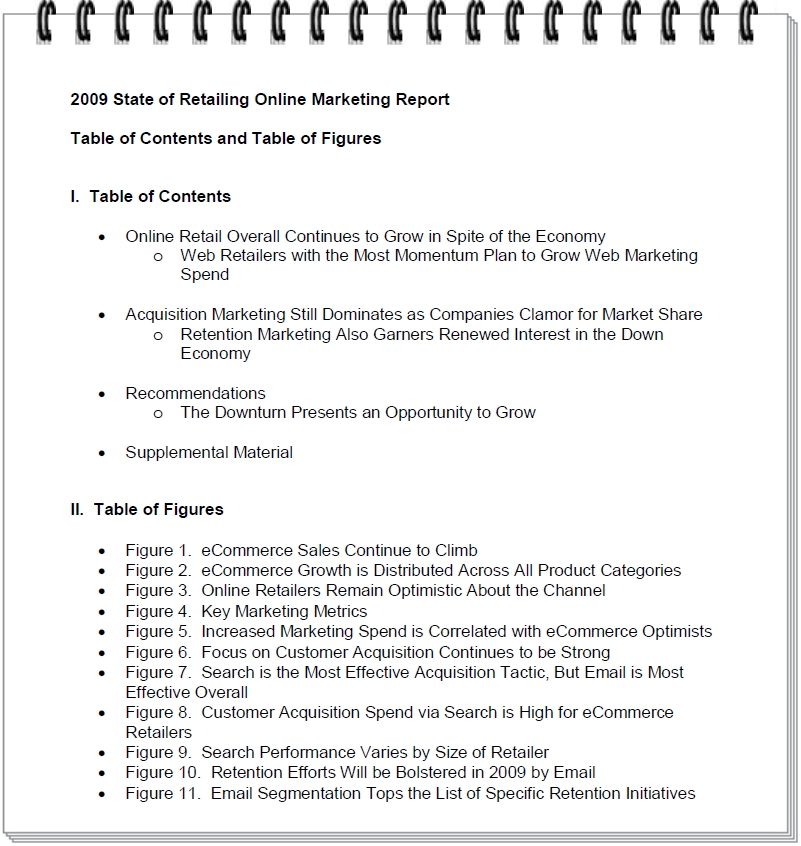

2009 State of Retailing Online: Marketing Report

May 5th, 2009 by Fiona Swerdlow, Head of Research, Shop.org

Today marks an annual milestone in the Shop.org calendar – we’re releasing to Shop.org Members the 2009 State of Retailing Online (SORO) Marketing Report. Much like last year, this report is the first installment of the three-part 2009 SORO research series that we produce in partnership with Forrester Research.

A few highlights:

Despite the economy, the Web channel perseveres. In addition to analyzing how trends and benchmarks are evolving in the online marketing space, this year we asked retailers how they perceive the impact of the economy on our industry. In general, over half of retailers surveyed told us they foresee slowing sales growth for the retail industry as a whole in the next twelve months. The Web channel, though, is quite a different matter: fully 80% of retailers feel that the online retail channel continues to be better suited to withstand an economic slowdown than other channels. For all the gloomy news we’ve heard of late, one third of retailers note that they have actually gained market share from competitors since the slowdown really hit in late 2008. Key performance indicators bear out this assessment further: for example, the average conversion rate still hovers between 3% and 3.5%.

Retention focus grows, but aquisition marketing still rules. We also asked retailers whether they had adjusted planned spending for their Web business this year. While almost half plan to stay the original course and spend largely as planned, approximately one third is ratcheting back spending, and the remaining quarter is actually increasing investment in their Web businesses beyond the original plan. Retailers cutting back will do so primarily in areas such as staffing and search, and by focusing on smaller initiatives. Those retailers now increasing spend for their Web business plan to further fuel areas such as search, email and social marketing, among other initiatives.

What does all this (and much more detail in the report) tell us? Looks like retailer focus on retention marketing this year has grown considerably in the past year – but acquisition marketing is as important as ever, signaling increased competition in the marketplace for customers and wallet share.

Read all about it… In addition to all of the areas noted above, the 2009 SORO Marketing Report also covers numerous other aspects of the online marketing world. These include retailers’ assessment of the effectiveness of various marketing tactics, both overall and specific to acquisition; customer acquisition spend; search performance metrics; and customer retention tactics and areas of focus this year. For several of these data points, we have been able to segment the data by either retailer size (measured in terms of total online sales in 2008) or type of retailer.

Shop.org Members may now download the full 2009 SORO Marketing Report. Our second SORO report, focusing on Merchandising, will be released in July in conjunction with the Shop.org Merchandising Workshop (see also more information about SORO). I look forward to your feedback on this research, and, if you are a retailer, to your participation in our next SORO survey later this spring.

Best – Fiona

State of Retailing Online (SORO)

Produced annually in partnership between Shop.org and Forrester Research, The State of Retailing Online (SORO) study is the highly anticipated research that brings details of Marketing, Merchandising and Profitability to the online retail community. This research serves many functions for retailers, from benchmarking performance in the marketplace, to highlighting marketing and merchandising best practices and guiding financial planning.

- SORO Survey Participation Sign Up

- SORO FAQ & Troubleshooting

- 2008 SORO Reports (members only)

- Purchase SORO

2009 Research Surveys and Reports

During the first half of 2009, Shop.org and Forrester Research are jointly deploying two surveys, designed to gather the most important details you need about marketing, merchandising, multi-channel integration, and profitability. The results of these two retailer surveys are being released in three separate reports: Marketing (May), Merchandising (July), and Profitability (September).

_________________________________________

2009 SORO Marketing Report

Released May 2009

The SORO Marketing Report covers areas such as:

- Marketing key performance indicators (KPIs)

- Impact of the current economic climate

- Marketing budget

- Allocation and effectiveness of marketing spending (both online and offline)

- Customer acquisition and retention

- Email marketing

- Search

Members, Download the Marketing Report

Non-Members: Purchase Here

Amazon's Large Screen kindle DX

Online retail giant Amazon.com unveiled a larger-screen version of Kindle electronic reader on Wednesday. Dubbed Kindle DX, the new reader it sports a 9.7-inch display, about two and a half times larger than the current Kindle. It's priced at $489, well above the $359 price point for the other Kindles. Amazon said it will start shipping the devices this summer.

As expected, Seattle-based Amazon.com Inc. (NASDAQ: AMZN) said a variety of college textbook publishers will start selling books through the Kindle online store. Amazon is also working with a group of universities, which will hand out hundreds of Kindle DX devices to students in the fall. Participating schools are Arizona State University, Case Western Reserve University, Princeton University, Reed College, and Darden School of Business at the University of Virginia.

The New York Times, Boston Globe, and Washington Post will offer Kindle DXs at a reduced price to readers who "live in areas where home-delivery is not available and who sign up for a long-term subscription to the Kindle edition of the newspapers," according to Amazon.

For pictures and more on Amazon's rollout of Kindle DX, go to TechFlash.com.

58% of Onlinie Retailers Saw Q1 Sales Increase

According to Practical eCommerce:

"Some retailers saw better than expected onlinesales in the first three months of 2009, according to the results of anew survey.

But it was not clear whether some online purchases werecoming at the cost of brick-and-mortar sales.

Shop.org, a division of the National Retail Federation, and Forrester Researchconducted a "flash" survey of some 80 retailers in April.

Of thoseretailers, 44 percent had seen double digit increases in online sales,and an additional 14 percent of respondents had sales grow up to 10percent for the first three months of 2009."

EMV Coming to America?

U.S. getting squeezed by EMV

Wednesday, May 6, 2009 in News

With Canada and Mexico both going to EMV and most of the rest of the world doing the same it may be a matter of time before U.S. card issuers are forced to go to chip and PIN. EMV in the U.S. was the topic of a panel at the CTST Conference in New Orleans.

Geography isn’t the only issue either, says Rene Bastien, product manger for payment products at SAFENET. It’s becoming more common for U.S. travelers in Europe to have transaction denied because retailers aren’t authorizing transactions with just the mag stripe. “EMV is happening everywhere.”

Jack Jania, vice president and general manager of secure transactions at Gemalto, says some U.S. banks are considering issuing EMV cards to high-end customers who frequently travel overseas.

Dual-interface cards are also starting to appear on the scene, Jania says. These cards have one chip but can perform EMV transaction through a contact interface as well as contactless.

Canada may also bring to bear some pressure for EMV, says Deb Baxley, managing partner at Keypoint Solutions. If Canadian issuers start to see credit card fraud add up with mag stripe transactions merchants could start denying the transactions.

So when will the U.S. make the move? It’s hard to say. “I hate to put a date on it,” Jania says.

But there has been progress. Two years ago U.S. issuers wouldn’t even talk about EMV but they are now, Jania says. [end]

On Cash Micropayments

Make way, Zambian kwacha. There's a hot new exotic currency on the market, only it's not from any country on earth—at least not one in the material world.

This currency is called the Project Entropia Dollar (PED) and it's used to buy and sell goods on the planet Calypso, in an online gaming world called Entropia Universe.

The PED is among a growing number of alternative currencies changing hands in virtual worlds, social networks, and other Web sites eager to make it easier for users to spend money and carry out other transactions while online.

"We'll try to make the link between real and virtual world as close as possible," says Hans Andersson, who in March was granted a license from the Swedish government to open Mind Bank, which will exchange Swedish kronor for PEDs. The game's 1 million users now buy and sell land, minerals, and tools by depositing U.S. dollars or Swedish kronor directly into the game. Once Mind Bank opens in January, users will be able to link real-world checking and savings accounts to the virtual world. Eventually they'll be able to take out PED loans.

Andersson hopes that as it becomes simpler to transfer funds from real-world financial institutions to those that exist on the Internet, site users will spend more time and money online. The difficulty of paying for goods in virtual worlds, online games, social networks, and even dating sites has long stymied growth in what analysts see as a burgeoning market. China's virtual goods economy, the largest in the world, is worth $800 million and growing 30% a year, estimates Shaun Rein, managing director at China Market Research Group. In Second Life, one of the biggest U.S.-based virtual economies, transaction volume is expected to rise 39%, to $500 million this year, according to the world's creator, Linden Research. "Our virtual economy has been on a tear," says Tom Hale, Linden's chief product officer. "It's grown much better than the real economy. It's a wonderful, wonderful business."

Facebook: Testing Virtual "Credits"

Services such as eBay's (EBAY) PayPal and credit and debit cards provide a way for people to pay for virtual goods or site-specific virtual currencies. But many users, including teens and people in emerging economies, don't have bank accounts or credit cards.

In the U.S., 95% of teens make purchases with cash, according to the Charles Schwab (SCHW) Teens & Money 2007 survey. Of China's 1.3 billion people, only 115 million own credit cards. And many players balk at the high fees levied by financial services on the sub-$1 transactions commonplace in the virtual-goods world. "There's a new category of transactions—micropayments—that traditional players have had trouble catering to," says Michael Ting, senior director at mobile-payments provider Obopay. Visa (V) and PayPal declined to comment for this story.

Web sites view alternative payment methods as a way to accelerate the sale of the virtual goods that are an important source of revenue, especially as demand for online ads slumps. On Apr. 3, social network Facebook announced that it is testing its own "credits," which would let users carry out transactions in certain subnetworks. News Corp.'s (NWS) MySpace is developing its own virtual currency and payment system.

Continue Reading at Businessweek

Stolen US Credit Cards Fund Terrorist Attacks

Terrorism funded with stolen data

Andrew R. Cochran, founder and Co-Editor of the Counterterrorism Blog, delivered a statement dated March 31, 2009, to the Subcommittee on Emerging Threats, Cybersecurity, and Science and Technology Hearing, United States House Committee on Homeland Security.

The statement entitled "Do the Payment Card Industry Data Standards Reduce Cybercrime?" outlined a number of instances in which stolen U.S. credit cards were used to fund terrorist attacks.

Cochran asked the subcommittee to review the evidence he was presenting and "the effectiveness of the PCI standards to reduce data breaches, identity theft and the potential funding of terrorism." He also extended an offer to assist them in that mission. The Counterterrorism Blog, with its host of experts from both the government and private sector, reports on and analyzes terrorist attacks and counterterrorism policies.

Cochran chaired a special panel in February 2009, Meta-Terror: Terrorism and the Virtual World. His statement to the subcommittee summarized information from that event and pertinent entries in the Counterterrorism Blog by its experts, including Dennis Lormel, who led the FBI's investigation into the financing of the Sept. 11 terrorist attacks. The following was included in his summary.

The plastic trail

- The 2004 Madrid train bombings and the 2005 London transportation system attack were paid for in part by credit card fraud.

- Indonesian and Jamaah Islamiah terrorist, Imam Samudra, who masterminded the 2002 Bali nightclub bombings, wrote a manifesto in prison in 2004 in which he recommended that Muslim radicals attack U.S. computers, which he described as vulnerable to hacking, credit card fraud and money laundering. That same year, Indonesian police noted that their country had the greatest incidence of credit card fraud in the world.

- Three terrorists set up shop on the Internet to provide forums, training, education, recruitment and outfitting for terrorists worldwide. They used computer viruses and stolen credit card accounts to fund the operation.

- The Liberation Tigers of Tamil Eelam financed international terrorist activities with credit card fraud.

Call for collaboration

Continue Reading at The Greensheet

Barney Frank Releases Details of Online Gambling Bill

US online gambling bill: details revealed

Operators will have to demonstrate that they have sufficient expertisein online gambling and sufficient financing to take bets, and that theyhave the systems and technology in place to combat money laundering andfraud, enforce relevant federal, state and Indian tribal laws includingtax collection on bets, and to protect children and problem gamblers.

The proposed licenses would last for five years. Anyone would be ableto apply for a license provided they meet the conditions above and thatthey provide their financial statements, and the criminal and credithistories of directors.

The documentproposes that the exact procedures for running background checks willbe decided by the Secretary of the Treasury later. The Secretary willbe charged with approving and monitoring licensees, and may call on theAttorney General to compel compliance.

The bill wouldprovide Treasury the authority to terminate the licenses of operatorswho fail to comply with the bill’s provisions, as well as to imprisonthem for up to five years.

Frank said he intends to move the bill before the House's August break.

Frank alsoannounced today that he is introducing separate legislation to delaythe implementation of regulations in the UIGEA, which are due to gointo effect on 1 December, until Congress has had a chance to decidenational policy.

Frank'slegislation is likely to be opposed by many Republicans, who dominatedthe House of Representatives when the UIGEA was passed in 2006 underBush. However Democrats are currently in control in both the House ofRepresentatives and the Senate, although Obama has not yet indicatedhow he will handle the issue.

While companieslike Sportingbet and 888 withdrew from America after the UIGEA waspassed, many still face possible US criminal prosecution for theiractivities there before 2006. PartyGaming recently settled with USauthorities for $105m, clearing the way for an M&A push (more).

Sharesin PartyGaming and 888 rose today on hopes that Frank will succeed. 888shares rose 7% to 104.75p; PartyGaming shares rose 6% to 276p.

More: American gaming industry split on online gaming bill.

Amazon Wants to Reverse Google's Move

In Alternative Payment Fight, Amazon Wants To Reverse Google’s Move

Written by Evan Schuman

With EBay with a seeminglytight lock on the first two slots, it’s been interesting watching twoother Web pioneers figuring out what to do. Google had invested inBillMeLater and was hoping to ride that horse against PayPal, untilPayPal bought all of BillMeLater. BillMeLater quickly then lost itsAmazon client and the war was on.

Google hasn’t been faring especially well, with some seeing Google’s move in April to boost pricesas desperate. Then on Thursday (April 30), Amazon counterpounched,offering to waive fees for five months for retailers who would be newcustomers for its Amazon Payments program.

The Amazon offer wasquite limited, excluding any existing consumers, having the fee waiveronly lasts five months (from April 29 through Sept. 30). Technically,it would be five months for those who signed up immediately. The dealisn’t for five free months, it’s free transactions until Sept. 30,apparently regardless of when a merchant signs up. The deal also has anespecially low ceiling, with Amazon saying that the fees will startsooner than Sept. 30 if $2 million or more is sold.

Continue Reading at StorefrontBacktalk written by Evan Schuman

RIM & Cisco to Launch BlackBerry Mobile Voice System (MVS)

Research in Motion (RIM) has announced a tie-up with network vendor Cisco to launch BlackBerry Mobile Voice System (MVS) Server for Cisco Unified Communications Manager.

The system can turn a user’s BlackBerry device into an extension of their desk phone, providing one contact phone number and one voicemail that works across both the mobile device and a Cisco Unified IP desk phone.

The user can transfer calls between the desk phone and the BlackBerry as well as make calls from the smartphone using either the BlackBerry phone number or enterprise line.

Full Article Here

Gartner Tells Banks "Beware of Disintermediation"

Retail banks face the prospect of disintermediation if they fail to prepare for the swelling interest in new media technologies and social networking by their customer base, according to analyst house Gartner.

Social banking won't change the consumer banking model immediately, says Gartner, although retail banks that understand social media, financial social networks and microfinance have a better chance of adapting their services.

Gartner defines social banking as an emerging approach to retail banking that makes depositing, lending and the connections between depositors, borrowers and financial institutions transparent.

Stessa Cohen, research director at Gartner, says the definition removes the banks from the centre of the customer relationship: "Instead the bank takes its place among a series of loosely connected financial and social relationships mediated by online social-networking media and tools."

Full Story at Finextra

Barney Frank to Unveil Online Gambling Bill

There's a LOT of money and tax to be made off Internet Gambling and in light of all the recent bailouts and spending, a giant influx of capital to the federal government would be enticing. But what could bring in a lot of money quickly? Barney Frank thinks it's Online Gaming. He's preparing to fight the fight. He might not win but I wouldn't bet that he'lll walk out a loser, as I imagine the online gaming lobbyists are pretty good tippers.

Here's an article from Reuters talking Frank.

WASHINGTON (Reuters) - U.S. Representative Barney Frank will unveil legislation on Wednesday (today's the day) to roll back a U.S. ban on online gambling, he said in a statement on Tuesday. The new bill would exempt operators that are licensed and regulated from the ban enacted in 2006, Frank said.

The Massachusetts Democrat said his legislation "will enable Americans to bet online and put an end to an inappropriate interference with their personal freedom." (Frank being Frank: You mean if I go to the ATM and withdraw $200, not even the Freedom of Information Act can tell people whether I bought potato chips or poker chips? Cool!)

The Frank bill is likely to be opposed by anti-gambling Republicans. The ban was imposed during the Bush administration and has damaged U.S.-European Union trade ties. European online gambling firms lost billions of euros in value after Congress made it illegal for banks and credit card companies to make payments to online gambling sites.

Republicans controlled the White House and Congress when the law was approved. Now, Democrats are in control in both branches of the government, but it is unclear how the Obama administration will handle the issue. Companies involved in the issue include PartyGaming Plc and 888.com.

(Reporting by Kevin Drawbaugh; Editing by Tim Dobbyn)