Digital Transaction News reports on the recent Javelin Strategy and Research Study which says Online Sales shouldn't be hurt to badly. I tend to go with the idea that bricks and mortar will be hurt not only by the economy, but "at the expense" of people trickling...should I say flocking...to e-commerce. (see graphic below right from when I talked about about the Paradigm Shift.

A Sour Economy Won’t Hurt Online Shopping Or Alternative Payments(November 12, 2008) Retail sales are slumping and stores are closing, but the online retailing channel—and thereby online payment transaction volumes—will come through relatively unscathed, according to a new report from Javelin Strategy and Research. Javelin’s latest online retail payments forecast predicts Internet retail purchases will total $148 billion this year, up 10.4% from an estimated $134 billion in 2007.

That’s much better than the outlook for overall retail sales. The U.S. Commerce Department recently estimated that retail and food sales adjusted for seasonal variations but not price differences were down in September by 1.2 % from August and by 1.0% from September 2007. The government’s estimate for October is due Friday, and many retailing analysts are predicting the worst Christmas spending season in years.

Wednesday, November 12, 2008

Sour E-conomy Doesn't E-qual Sour Grapes for E-Commerce

PCI DSS Version 1.2 Webinar

Want a Crash Course in Understanding PCI DSS Version 1.2?

The PCI Security Standards Council, the standards body providing management of the Payment Card Industry Data Security Standard (PCI DSS), PIN Entry Device (PED) Security Requirements and the Payment Application Data Security Standard (PA-DSS), has announced it will be offering a complimentary webinar,

"Understanding PCI DSS Version 1.2...to be held on Tuesday Nov. 25, 2008 at 11:30 a.m. EST (and at 7:30 p.m. EST.)

The session will be repeated on Wednesday Dec. 17, 2008 at 10:30 a.m. EST and 8:30 p.m. EST.

These one hour webinars are designed for merchants and service providers who are implementing the PCI DSS and want to better understand the changes brought about with version 1.2 which was released on Oct. 1, 2008. The series and will feature Bob Russo, General Manager of the Council and Lauren Holloway, Chairperson of the Council’s Technical Working Group. During each session Mr. Russo and Ms. Holloway will address key elements of version 1.2 and what it means for any organization’s compliance efforts.

Webinar participants will discover:

- Elements of each of the 12 requirements of version 1.2;

- What has changed from version 1.1

- Key dates for version 1.2;

- The intent of the Council in making any changes.

To register for the 11:30 a.m. EST session on Nov, 25 click http://register.webcastgroup.com/event/?wid=0801125084404 and for the 7:30 p.m. EST session click http://register.webcastgroup.com/event/?wid=0801125084405.

To register for the 10:30 a.m. EST session on Dec. 17 click http://register.webcastgroup.com/event/?wid=0801217084406 and for the 8:30 p.m. EST session click http://register.webcastgroup.com/event/?wid=0801217084407.

These webinars will be recorded and available for download on the Council’s Web site for those who cannot attend any of the sessions.

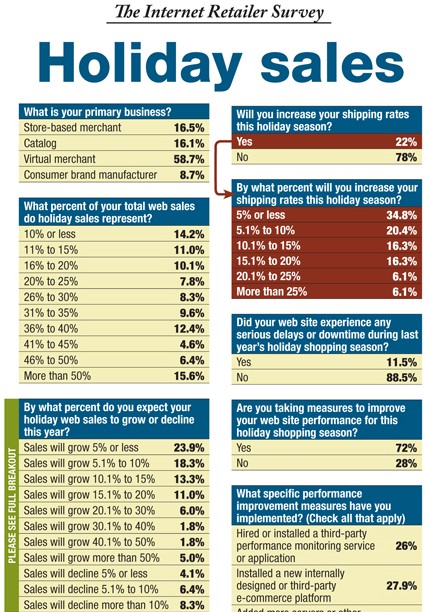

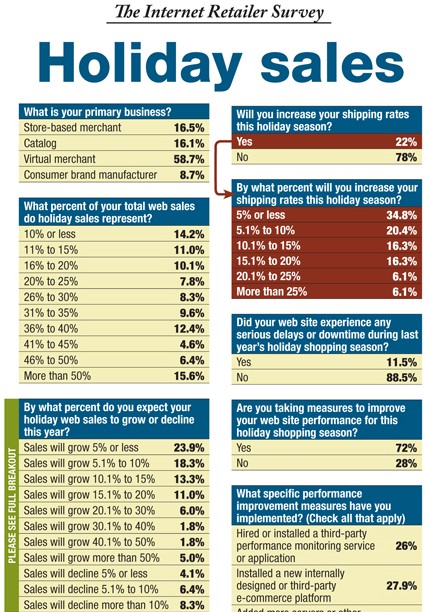

Internet Retailer: 81% Believe Holiday Online Sales Will Grow

InternetRetailer.com - As the economy sinks, will the sleigh rise?

Even in the midst of economic chaos, 81% of retailers believe their online sales will grow this holiday season

By Bill Siwicki

With the economy teetering on the brink and consumers frazzled by the sinking stock market and manic efforts of elected officials, the big question in retail today is: Will holiday sales this season be HO-HO-HO or HO-OH-NO? It depends on the sales channel, retailers, research firms and analysts say. Sales have been down this year, in some cases significantly, in bricks-and-mortar stores. However, online sales continue to grow—though not at the rapid pace of years past.

Even amid economic turmoil, 81.1% of retailers believe their holiday web sales will grow to some degree this season, according to the latest Internet Retailer survey. This is good news—for the most part, some analysts say.

“It is encouraging to see four out of five expect to grow web sales in the face of such a poor economy,” says Jim Okamura, senior partner at retail consulting firm J.C. Williams Group Ltd. “However, that one-in-five figure is higher than I’ve seen in a long time, especially in the face of continuing online sales growth where the focus being paid to the online channel has never been higher.”

Continue Reading at Internet Retailer.com

New Look Quarterly from Forrester Research

Received an email from Forrester Research and found it interesting enough to share. I'm sure they don't mind since they invited me to share/email this with anyone, so I am. This particular report aims to provide insight from eBiz-execs seeking to grow their eBiz.

If you'd like further information on how to subscribe to First Look Quarterly's you may click here. If you'd l ike to participate in their eBusiness Panel, you can sign up here. Here's the email:

Welcome to the new First Look designed specially for eBusiness & Channel Strategy professionals!

Whatever your politics, you can't envy Barack Obama. He's just walked into the biggest economic disaster in American history. Housing prices are plummeting, businesses are unable to raise capital, unemployment is rising, the stock market hasn't displayed signs of a bottom yet, and consumer confidence is at the lowest level since the University of Michigan even started to measure the metric. There's a guy out there who calls himself Dr. Doom who thinks that it could take decades to recover. It's enough to make just about anyone want to crawl into a hole and hibernate until there's better news.

Anyone, that is, but an eBusiness manager. Because if there is a silver lining in this cloud, it is that the online sector of nearly every consumer-facing business continues to experience growth and garner executive attention. From a Forrester survey of eBusiness executives, we know that the key reasons why an online business exists are to acquire new customers, reduce the current cost of servicing customers, and retain existing customers. The impact of the Web channel is clear and quantifiable, and that should leave you in pretty good shape.In fact, 72% of retailers said that the Web channel is better suited to withstand an economic slowdown than other channels. But a downturn is never a good thing, and companies have a bad habit of killing even the geese that lay the golden eggs during tough times. What are the things you need to be prepared for?

We see three:So what to do? eBusiness managers should be doing several things to address these changes. In the short term, we suggest three strategies.

- A continued slump in consumer confidence. With all the bad news out there, how can customers or businesses possibly be anything but uncertain about the future? Your Web site is in a unique position to address this challenge.

- Demand for value. If "trading up" was the catchphrase of the last decade, you can bet money that "trading down" will be an imperative for indebted, cash-flow-negative consumers to get the most out from the limited resources they do have. Is it any wonder that Wal-Mart, whose mantra is "Everyday low prices," is one of the only stores to experience positive comp store sales in recent months?

- High customer acquisition costs. As consumers and businesses are tighter with their wallets, marketing spend is less likely to yield much bang for the buck. That means focusing on your customers who know you, love you (or at least tolerate you), and are likely to spend more with you. In other words, this means more need to focus on customer retention.

Addressing customer confidence issues in your digital contact points. If your business is in good shape, don't be afraid to trumpet it -- on your home page, on log-in pages, in your emails. We received an email from Citizens Bank recently that said just that: The times are uncertain, but your deposits are not. What a comforting message during turbulent times that many eBusiness executives ignore. In fact, one in five US online travelers avoids destinations because a Web site's content doesn't make them feel comfortable; 26% cite the same problem with hotel Web sites.

Boosting customer care. There may be places to cut funds, but if you are in an industry where consumers are skittish, make sure that you have human help on hand to answer questions and allay concerns. When consumers want customer service, they are most likely to either go to a store or call a service rep. Interactive chat and click-to-call show promise, especially for online banking sites. In a recent survey, we found that while 85% of researchers who contacted a firm during the research process used the phone, just 43% found that method helpful. By contrast, just 47% used click-to-call, but satisfaction rates were significantly higher at 61%

Perfecting retention marketing strategies. The king of all digital retention tactics is email marketing, and it's time to make sure you're not just batching and blasting your entire customer base with irrelevant messages. Segment your best customers, and create useful content that will engage them and give them a reason to interact with you even when their liquidity is low.

That's just the tip of the iceberg. We have many documents that we've published recently and have on our docket in the coming weeks to advise various eBusiness groups on weathering the economic storm. The good news is that if you're reading this, you'll likely be one of the players that not only emerges from this downturn intact, but stronger and better than before.

Seeing the glass half full,

Sucharita Mulpuru

Research Referenced In This Issue

Brand-Building Online Content Matters For eBusiness And Channel Strategy In A Recession (47266)

How To Get Customers To Shop Online (45822)

Optimizing Customer Retention Programs (44400)

The Business Case For Interactive Help In Financial Services (42472)

The Cost Of eBusiness Operations And Customer Acquisition (46111)

The State Of Retailing Online 2008: Profitability, Economy, And Multichannel Report (45508)

Subscribe to:

Comments (Atom)