WAKEFIELD, Mass.--(

BUSINESS WIRE)--

EMVCo and the

NFC Forum have agreed to work together to optimize the development and testing processes of Near Field Communication (NFC)-enabled mobile devices for vendors, through exploring alignment of the two organizations' specifications, and cross-recognition of test results. The alliance will offer significant benefits to stakeholders involved in EMV-related NFC use cases and products in the contactless payments industry by reducing product time-to-market and decreasing certification costs.

“At the NFC Forum, we want to make it fast and affordable for organizations to build and deploy EMV-based NFC solutions. By working closely with EMVCo, we’re able to better support vendors while furthering our commitment to global interoperability.”

EMVCo, the EMV® standards body collectively owned by American Express, JCB, MasterCard and Visa, has signed a Collaboration Agreement with the NFC Forum, a non-profit industry association that advances the use of NFC technology. The goal of the collaboration is to establish a framework to synchronize NFC Forum and EMVCo Specifications, test plans, test tools, laboratory accreditations and the management of contactless product certification. The framework will ultimately streamline the development and testing process of contactless technology for vendors.

Activity will focus on Level 1 functionality, which covers contactless communication protocol. Initial efforts will center on outlining the scope of work and the specifications to be covered. These efforts will be followed by a gap analysis to identify and examine specification differences, agree on specification updates where necessary, and how agreed amendments will be collectively managed.

Joe Cunningham, current Chair of the EMVCo Executive Committee, comments: “To enable contactless to reach its full potential and facilitate the delivery of secure payment solutions, we need to create an efficient testing and certification framework that allows products to be swiftly brought to market. Alignment between industry bodies is therefore essential to ensure we apply specialist knowledge and a cohesive approach to the creation of this very innovative ecosystem. EMVCo recognizes the importance of our work with the NFC Forum and is committed to progressing activity as a priority.”

Koichi Tagawa, NFC Forum Chairman, adds: “At the NFC Forum, we want to make it fast and affordable for organizations to build and deploy EMV-based NFC solutions. By working closely with EMVCo, we’re able to better support vendors while furthering our commitment to global interoperability.”

About EMVCo

EMVCo LLC was formed in February 1999 by Europay, MasterCard and Visa to manage, maintain and enhance the EMV Integrated Circuit Card Specifications for Payment Systems. With the acquisition of Europay by MasterCard in 2002, JCB joining the organisation in 2004 and American Express becoming its fourth member in 2009, EMVCo is currently operated by American Express, JCB, MasterCard and Visa.

EMVCo's primary role is to manage, maintain and enhance the EMV Integrated Circuit Card Specifications to ensure interoperability and acceptance of payment system integrated circuit cards on a worldwide basis.

EMVCo also maintains type approval processes for terminal compliance testing and Common Core Definitions (CCD) and Common Payment Application (CPA) card compliance testing. These testing processes ensure that a single terminal and card approval process is developed at a level that will allow cross payment system interoperability through compliance with the EMV specifications. Additional information can be found at

www.emvco.com.

About the NFC Forum

The NFC Forum (

http://www.nfc-forum.org) was launched as a non-profit industry association in 2004 by leading mobile communications, semiconductor, and consumer electronics companies. The Forum's mission is to advance the use of Near Field Communication technology by developing specifications, ensuring interoperability among devices and services, and educating the market about NFC technology. The Forum's 170+ global member companies currently are developing specifications for a modular NFC device architecture, and protocols for interoperable data exchange and device-independent service delivery, device discovery, and device capability.

The NFC Forum’s Sponsor members, which hold seats on the Board of Directors, include leading players in key industries around the world. The Sponsor members are: Barclaycard, Broadcom Corporation, INSIDE Secure, Intel, MasterCard Worldwide, NEC, Nokia, NTT DOCOMO, Inc., NXP Semiconductors, Renesas Electronics Corporation, Samsung, Sony Corporation, STMicroelectronics, and Visa Inc.

®EMV is a registered trademark in the U.S. and other countries and an unregistered trademark elsewhere. The EMV trademark is owned by EMVCo.

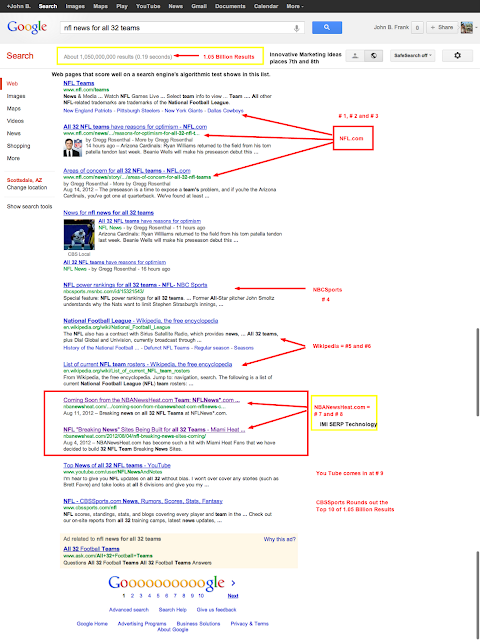

IMI creates and builds "breaking news" websites around industry specific keywords. Our proprietary "NewsBots" scour the web for specific keywords and once a breaking news story surrounding the keyword is found, it is sent to our server and edited into a news posting containing a Title, Photo, author credit, 25 word blurb and a direct link to the original content provider. The process is well served by the search engines and works as a traffic magnet. We will provide "targeted traffic" to any vertical, any niche, any subject. Click here to request more info Live Site Examples: Near Field Communication News or take a look at the "Breaking News Site" we built for the NBA's Miami Heat. NBANewsHeat.com Visit Breaking News = Traffic to learn how your industry related breaking news website can be a "targeted" traffic magnet.