| Image via CrunchBase |

Economic Outlook and Higher Household Spending Drives Index to Lowest Level in 2012

RIVERWOODS, Ill.--()--Economic concerns and anticipation of continued higher expenses pushed the Discover U.S. Spending Monitor to its lowest level of the year in August, declining 0.7 points from July to 88.6. The Monitor is a 5-year-old daily poll tracking economic confidence and spending intentions of nearly 8,200 consumers throughout the month. August marked the third consecutive monthly increase for those believing the economy is getting worse.

Highlights of Discover U.S. Spending Monitor Results June July August 2012 2012 2012 Discover U.S. Spending Monitor Index 90.7 89.3 88.6 U.S. Economy Improving 29% 28% 26% Personal Finances Improving 23% 23% 20%

Economic Rating at 9-Month Low

While the number of respondents reporting the U.S. economy as poor leveled out from June to July, 56 percent of respondents ranked the economy as poor in August. This was the highest level since January 2012.

- Respondents with children who view the economy as poor increased 7 percentage points from July to August to 58 percent. Respondents without children viewing the economy as poor remained unchanged at 54 percent.

- There was an 8-percentage point increase to 50 percent in the number of consumers making $75,000 or more viewing the economy as poor. This compared with little change for those making between $40,000 and $75,000, poor rating declined 1 percentage point to 53 percent, and those making less than $40,000, poor rating increased 1 percentage point to 62 percent.

- Respondents believing the economy is getting worse increased for the third straight month to 55 percent, up 2 percentage points from July and 11 points from March 2012.

- In August, 54 percent of women believed the economy was getting worse, an increase of 4 percentage points from the previous month, while 56 percent of men had the same belief, a decline of 1 percentage point.

Consumers Believing Their Personal Finances are Getting Worse Reaches 10-Month High

- Fifty-one percent believe their personal finances are getting worse, an increase of 2 percentage points from the previous month. This is the highest level since October 2011 when 55 percent of respondents felt their personal finances were getting worse.

- However, there was little change in how respondents currently rate their personal finances in August, with 34 percent rating their personal finances as good or excellent, equal to July, 38 percent rating them as fair, down 1 percentage point from July, and 25 percent rating them as poor, also equal to July.

High Food and Gas Prices May be Affecting Discretionary Spending Intentions

Of all respondents, 31 percent plan to spend more next month (an increase of 4 percentage points from the prior month). This is the highest number reported for August since 2008 and may reflect steadily rising food prices and record-high national average gas prices during the month.

- For all respondents, 44 percent expect to spend more on household expenses such as gas and groceries in the next month, an increase of 6 percentage points from July and the highest number reported for August since 2008.

- 49 percent plan to spend less on going out to dinner or the movies in the month ahead, an eight-month high and up 2 percentage points from July.

- 48 percent plan on spending less on home improvement purchases, up 1 point from July.

- 46 percent plan on spending less on a major purchase such as a vacation, a 2-point increase from July.

Consumers were asked for the first time in August how much they plan to spend on back-to-school shopping, with nearly two-thirds indicating they plan to spend less than $250 this year. Specifically, 35 percent plan to spend less than $100, and 30 percent plan to spend between $100 and $250.

Compared to last year, 38 percent plan to spend the same on back-to-school shopping. Thirty-two percent plan to spend less than they did a year ago, and 29 percent plan to spend more.

About Discover U.S. Spending Monitor

The Discover U.S. Spending MonitorSM is a monthly index of consumer spending intentions and capacity that is based on interviews with a random sample of 8,200 U.S. adults conducted at a rate of 275 per night. In addition to spending, the survey asks consumers their opinions on the U.S. economy and their personal finances. The Monitor began in May 2007 with a base index of 100. Surveys are conducted by Rasmussen Reports, an independent survey research firm (http://www.rasmussenreports.com).

About Discover

Discover Financial Services (NYSE: DFS) is a direct banking and payment services company with one of the most recognized brands in U.S. financial services. Since its inception in 1986, the company has become one of the largest card issuers in the United States. The company operates the Discover card, America's cash rewards pioneer, and offers home loans, private student loans, personal loans, online savings accounts, certificates of deposit and money market accounts through its direct banking business. Its payment businesses consist of Discover Network, with millions of merchant and cash access locations; PULSE, one of the nation's leading ATM/debit networks; and Diners Club International, a global payments network with acceptance in more than 185 countries and territories. For more information, visit www.discoverfinancial.com.

Economic Outlook and Higher Household Spending Drives Index to Lowest Level in 2012

RIVERWOODS, Ill.--()--Economic concerns and anticipation of continued higher expenses pushed the Discover U.S. Spending Monitor to its lowest level of the year in August, declining 0.7 points from July to 88.6. The Monitor is a 5-year-old daily poll tracking economic confidence and spending intentions of nearly 8,200 consumers throughout the month. August marked the third consecutive monthly increase for those believing the economy is getting worse.

| Highlights of Discover U.S. Spending Monitor Results | |||||||||

| June | July | August | |||||||

| 2012 | 2012 | 2012 | |||||||

| Discover U.S. Spending Monitor Index | 90.7 | 89.3 | 88.6 | ||||||

| U.S. Economy Improving | 29% | 28% | 26% | ||||||

| Personal Finances Improving | 23% | 23% | 20% | ||||||

Economic Rating at 9-Month Low

While the number of respondents reporting the U.S. economy as poor leveled out from June to July, 56 percent of respondents ranked the economy as poor in August. This was the highest level since January 2012.

- Respondents with children who view the economy as poor increased 7 percentage points from July to August to 58 percent. Respondents without children viewing the economy as poor remained unchanged at 54 percent.

- There was an 8-percentage point increase to 50 percent in the number of consumers making $75,000 or more viewing the economy as poor. This compared with little change for those making between $40,000 and $75,000, poor rating declined 1 percentage point to 53 percent, and those making less than $40,000, poor rating increased 1 percentage point to 62 percent.

- Respondents believing the economy is getting worse increased for the third straight month to 55 percent, up 2 percentage points from July and 11 points from March 2012.

- In August, 54 percent of women believed the economy was getting worse, an increase of 4 percentage points from the previous month, while 56 percent of men had the same belief, a decline of 1 percentage point.

Consumers Believing Their Personal Finances are Getting Worse Reaches 10-Month High

- Fifty-one percent believe their personal finances are getting worse, an increase of 2 percentage points from the previous month. This is the highest level since October 2011 when 55 percent of respondents felt their personal finances were getting worse.

- However, there was little change in how respondents currently rate their personal finances in August, with 34 percent rating their personal finances as good or excellent, equal to July, 38 percent rating them as fair, down 1 percentage point from July, and 25 percent rating them as poor, also equal to July.

High Food and Gas Prices May be Affecting Discretionary Spending Intentions

Of all respondents, 31 percent plan to spend more next month (an increase of 4 percentage points from the prior month). This is the highest number reported for August since 2008 and may reflect steadily rising food prices and record-high national average gas prices during the month.

- For all respondents, 44 percent expect to spend more on household expenses such as gas and groceries in the next month, an increase of 6 percentage points from July and the highest number reported for August since 2008.

- 49 percent plan to spend less on going out to dinner or the movies in the month ahead, an eight-month high and up 2 percentage points from July.

- 48 percent plan on spending less on home improvement purchases, up 1 point from July.

- 46 percent plan on spending less on a major purchase such as a vacation, a 2-point increase from July.

Consumers were asked for the first time in August how much they plan to spend on back-to-school shopping, with nearly two-thirds indicating they plan to spend less than $250 this year. Specifically, 35 percent plan to spend less than $100, and 30 percent plan to spend between $100 and $250.

Compared to last year, 38 percent plan to spend the same on back-to-school shopping. Thirty-two percent plan to spend less than they did a year ago, and 29 percent plan to spend more.

About Discover U.S. Spending Monitor

The Discover U.S. Spending MonitorSM is a monthly index of consumer spending intentions and capacity that is based on interviews with a random sample of 8,200 U.S. adults conducted at a rate of 275 per night. In addition to spending, the survey asks consumers their opinions on the U.S. economy and their personal finances. The Monitor began in May 2007 with a base index of 100. Surveys are conducted by Rasmussen Reports, an independent survey research firm (http://www.rasmussenreports.com).

About Discover

Discover Financial Services (NYSE: DFS) is a direct banking and payment services company with one of the most recognized brands in U.S. financial services. Since its inception in 1986, the company has become one of the largest card issuers in the United States. The company operates the Discover card, America's cash rewards pioneer, and offers home loans, private student loans, personal loans, online savings accounts, certificates of deposit and money market accounts through its direct banking business. Its payment businesses consist of Discover Network, with millions of merchant and cash access locations; PULSE, one of the nation's leading ATM/debit networks; and Diners Club International, a global payments network with acceptance in more than 185 countries and territories. For more information, visit www.discoverfinancial.com.

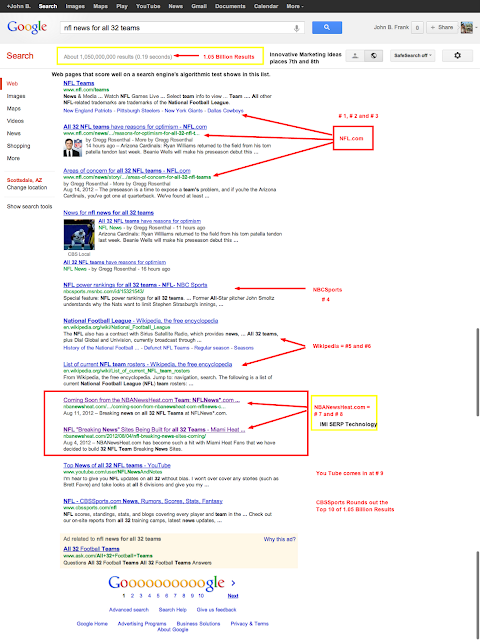

Advertisement from IMI, the Publisher of ePayment News:

IMI creates and builds "breaking news" websites around industry specific keywords. Our proprietary "NewsBots" scour the web for specific keywords and once a breaking news story surrounding the keyword is found, it is sent to our server and edited into a news posting containing a Title, Photo, author credit, 25 word blurb and a direct link to the original content provider. The process is well served by the search engines and works as a traffic magnet. We will provide "targeted traffic" to any vertical, any niche, any subject. Click here to request more info Live Site Examples: Near Field Communication News or take a look at the "Breaking News Site" we built for the NBA's Miami Heat. NBANewsHeat.com Visit Breaking News = Traffic to learn how your industry related breaking news website can be a "targeted" traffic magnet.

To provide you with an idea of the power behind our technology, we recently announced the upcoming release of NFLNews*.com (* denotes the name of the team) So let's use the search term: "NFL News for All 32 Teams." Relatively generic, and keep in mind we're competing with the likes of The NFL, ESPN, NBCSports, CBSSports, YouTube, Wikipedia, ABCSports, and myriad other established sites.

So how do we perform? Admirably.

Out of 1.05 Billion Search Results,

IMI is #7 and #8 (see below)

Out of 1.05 Billion Search Results,

IMI is #7 and #8 (see below)

Click the graphic below to enlarge: