HOUSTON--(

BUSINESS WIRE)--Financial institutions participating in the

2012 Debit Issuer Study, commissioned by PULSE, experienced strong growth in debit transaction volume in 2011 amid profound regulatory changes.

“The impact of Reg. II is being felt most strongly by regulated entities”

“The latest Debit Issuer Study provides more evidence that growth in debit remains robust even in the face of significant regulatory headwinds,” said Steve Sievert, Executive Vice President of Marketing and Communications for PULSE.

The Federal Reserve’s Regulation II capped the maximum interchange fees that financial institutions with at least $10 billion in worldwide assets could receive on debit card transactions. These issuers report fundamental shifts in their debit business. The relative importance of PIN debit versus signature debit and interest in debit rewards were impacted by the regulation. Eighty-nine percent of large issuers indicate that regulatory pressure will be a key challenge in the coming year.

Impact of New Regulation

Regulation II has two major components: a cap on debit interchange rates and a prohibition on debit network exclusivity. The interchange cap, which applies to issuers with at least $10 billion in assets, went into effect October 1, 2011. These large, “regulated” debit issuers are limited to a $0.21 plus 0.05% interchange fee per transaction, in addition to $0.01 to the extent that such issuers qualify for the fraud-prevention adjustment.

The cap on interchange rates has significantly reduced debit revenue; the average interchange rate for regulated issuers declined by 55 percent for signature transactions and by 28 percent for PIN transactions. Issuers’ interest in market growth has shifted from more costly signature debit transactions toward lower-cost PIN transactions. Additionally, issuers are seeking to increase small-ticket, cash-displacement transactions, since revenue is now primarily driven by the number of transactions rather than the amount spent.

“The impact of Reg. II is being felt most strongly by regulated entities,” said Inderpreet Batra, an Oliver Wyman partner who helped lead the Debit Issuer Study. “While interchange fees for regulated issuers declined by more than half for signature transactions, ‘exempt’ institutions took only a 3 percent hit – at least so far.” Exempt issuers’ gross margin per debit transaction is now more than double that of regulated institutions.

The new cap on debit interchange caused an 87 percent decline in the rate on business debit signature transactions. Business debit transactions were one of the key growth areas for issuers in prior years but are now unprofitable on a per-transaction basis for some issuers. Some issuers surveyed reported network fees that were almost equal to the effective interchange rate. As with consumer transactions, these effects are limited to regulated institutions.

Given the decline in revenue, there is much less interest in traditional issuer-funded debit rewards programs. Half of all regulated issuers with a rewards program terminated their program in the last year and another 18 percent plan to end or restructure their programs in 2012; another 40 percent do not have a rewards program and do not plan to introduce any kind of rewards proposition.

On April 1, 2012, all debit cards were required to participate in two unaffiliated debit networks. This requirement could be met by changing signature networks, adding an unaffiliated PIN network, or changing PIN networks. Almost all issuers in the study complied with the regulation by participating in an additional unaffiliated PIN network rather than performing an outright switch. The shift toward multiple networks provides routing choice to merchants and acquirers. Generally, issuers expressed concern about how the new network dynamics would play out.

Growth in the Debit Market

Seventy-six percent of consumers now have debit cards, up from 73 percent in 2010. The average active consumer debit cardholder spent $8,326 on their card in 2011, up from $7,781 in the prior year. The primary source of this increase was greater usage per card, with active users performing an average of 18.3 purchases per month compared with 16.3 per month in 2010.

The debit market is expanding at the low-end, with small-ticket transactions continuing to displace cash. While the average ticket on a debit transaction is $38, the median is just $19, with more than 30 percent of transactions now less than $10.

Consumer volume grew by 11 percent for signature transactions and 9 percent for PIN transactions, exceeding issuers’ expectations of 7 percent growth in both categories. In the year ahead, issuers expect the market to continue to grow across both consumer and business debit cards, with 15 percent growth in PIN transactions and 8 percent in signature transactions. Sixty-nine percent of regulated issuers and 76 percent of exempt FIs agreed that focusing on improving penetration, activation and usage for debit cardholders is key to growth in 2012.

About the Study

The

2012 Debit Issuer Study is the seventh installment in the study series. The study provides an objective fact base on debit card issuer performance and financial institutions’ outlook for the debit card business. Fifty-seven financial institutions – including large banks, credit unions and community banks – participated in the study, conducted by Oliver Wyman, a global leader in management consulting. Collectively, the participants issue 87 million debit cards and operate 47,000 ATMs. The sample is representative of the U.S. debit market in terms of institution type, location and debit network participation. For additional information about the study, visit

www.pulsenetwork.com/distudy.

About PULSE

PULSE, a Discover Financial Services (NYSE: DFS) company, is a leading debit/ATM network, serving more than 6,300 financial institutions across the United States. This includes 4,300 issuers with which PULSE has direct relationships and more than 2,000 additional issuers through agreements PULSE has with other debit networks. PULSE links cardholders with ATMs and POS terminals at retail locations nationwide. Through its global ATM network, PULSE provides worldwide cash access for Diners Club and Discover cardholders through more than 850,000 ATM locations. The company also is a source of electronic payments research and is committed to providing its participants with education on emerging products, services and trends in the payments industry. For more information, visit

www.pulsenetwork.com or follow PULSE on Twitter @PULSENetwork.

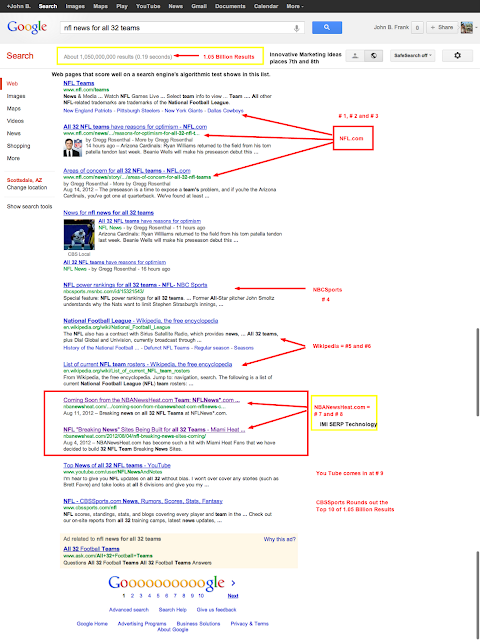

IMI creates and builds "breaking news" websites around industry specific keywords. Our proprietary "NewsBots" scour the web for specific keywords and once a breaking news story surrounding the keyword is found, it is sent to our server and edited into a news posting containing a Title, Photo, author credit, 25 word blurb and a direct link to the original content provider. The process is well served by the search engines and works as a traffic magnet. We will provide "targeted traffic" to any vertical, any niche, any subject. Click here to request more info Live Site Examples: Near Field Communication News or take a look at the "Breaking News Site" we built for the NBA's Miami Heat. NBANewsHeat.com Visit Breaking News = Traffic to learn how your industry related breaking news website can be a "targeted" traffic magnet.