Qkr adds bar tab feature allowing you to pay for individual items or rounds without leaving cards behind

Qkr! with Masterpass enables consumers to seamlessly order and pay for goods and services via their smart phone without having to wait in line or for a restaurant server. The app uses

Masterpass, a global digital payment service that speeds up the checkout process without requiring consumers to enter their financial and shipping information at every new merchant site.

In 2017, Mastercard will expand the Qkr platform to six additional markets – Brazil, Canada, Ireland, Singapore, South Africa and the United States – to seamlessly pay for fees, supplies and excursions at schools, and make payments at gas stations, parking, sports arenas, and unattended retail such as vending machines. Mastercard is also

partnering with Oracle to integrate Qkr and Masterpass in Oracle point-of-sale software and systems to scale these digital payment platforms to merchants worldwide.

“Today, we’re looking for convenience in all parts of our lives,” said Betty DeVita, chief commercial officer, Digital Payments and Labs, Mastercard. “Though grab-and-go retail is becoming increasingly popular with those on the move, consumers maintain high customer service expectations. Qkr! with Masterpass provides them with a frictionless retail experience – bringing together self-service, fast, seamless payments and card safety and security in new and unique ways.”

“At wagamama, we believe in the philosophy of ‘kaizen’ or ‘good change’ and Qkr is helping us to deliver this,” said Richard Talboy, director IT, wagamama. “With Qkr, our guests have the control to pay when they want and leave when they are ready rather than having to wait for the bill, which means that the server is freed up to spend more time on delivering great service. In a customer-service environment, the focus should be on brilliant food, great service and making the occasion fun for our guests, and paying with Qkr removes any needless fuss around a bill.”

With Qkr, restaurants and cafés can accommodate more customers and easily introduce new services like takeaway. Qkr eases the pressure of managing payments and enables the staff to focus exclusively on service. It also allows restaurants to offer targeted promotions directly to customers and develop reward programs that foster engagement and loyalty.

The platform’s web-based, management portal helps retailers view and manage menus, product inventory and pricing.

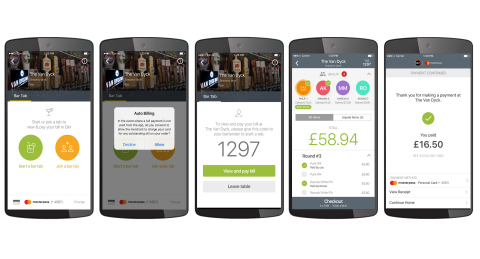

Going Cashless at the Bar with Qkr! with Masterpass

Mastercard is adding a new feature to Qkr called “Open Tab” that enables customers to open a tab at the bar without depositing a payment card or an identity document like a driver’s license with the bartender.

Research shows that diners often have to wait as long as 12 minutes to flag a server, receive the bill and make a payment. Forgetting and leaving a payment card behind is also a common phenomenon. With “Open Tab,” customers are able to see their order on their phone and pay via their mobile device when they are ready. Bills can be easily split between multiple customers who can either select and pay for individual items or choose to pay for one or more rounds. Masterpass speeds the checkout process, eliminating the wait. The feature will be available to restaurants in summer of 2017.

The Masterpass vision is to support all forms of commerce to address the full range of merchant experiences and consumer needs. With Masterpass, Mastercard delivers an omni-channel all-digital payment service for issuers, merchants and consumers. For more information visit

www.masterpass.com.

About Mastercard

Mastercard (NYSE: MA),

www.mastercard.com, is a technology company in the global payments industry. We operate the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. Mastercard products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone. Follow us on Twitter

@MastercardNews, join the discussion on the

Beyond the Transaction Blog and

subscribe for the latest news on the

Engagement Bureau.