An ATM in Your Pocket Can Be NYCE - 04..2009 - Bank Technology News Article

News Article

News Article

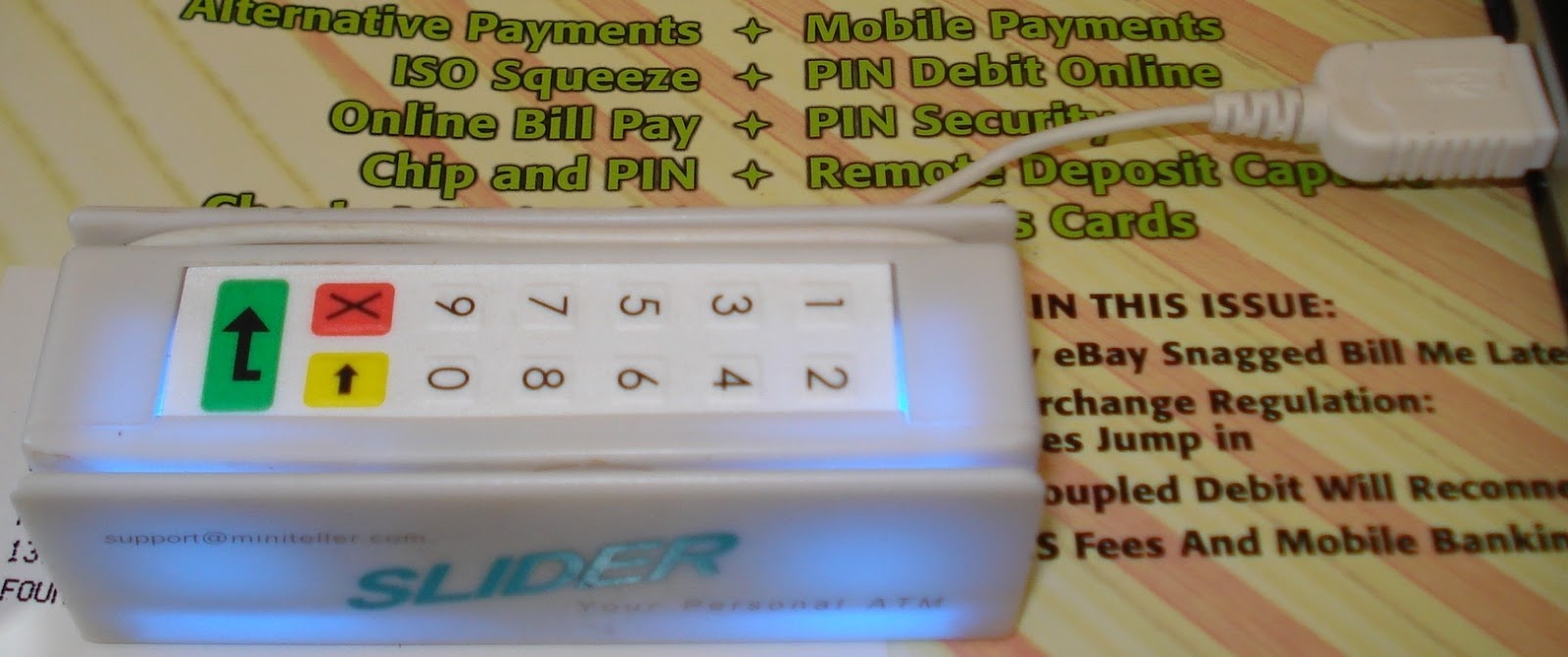

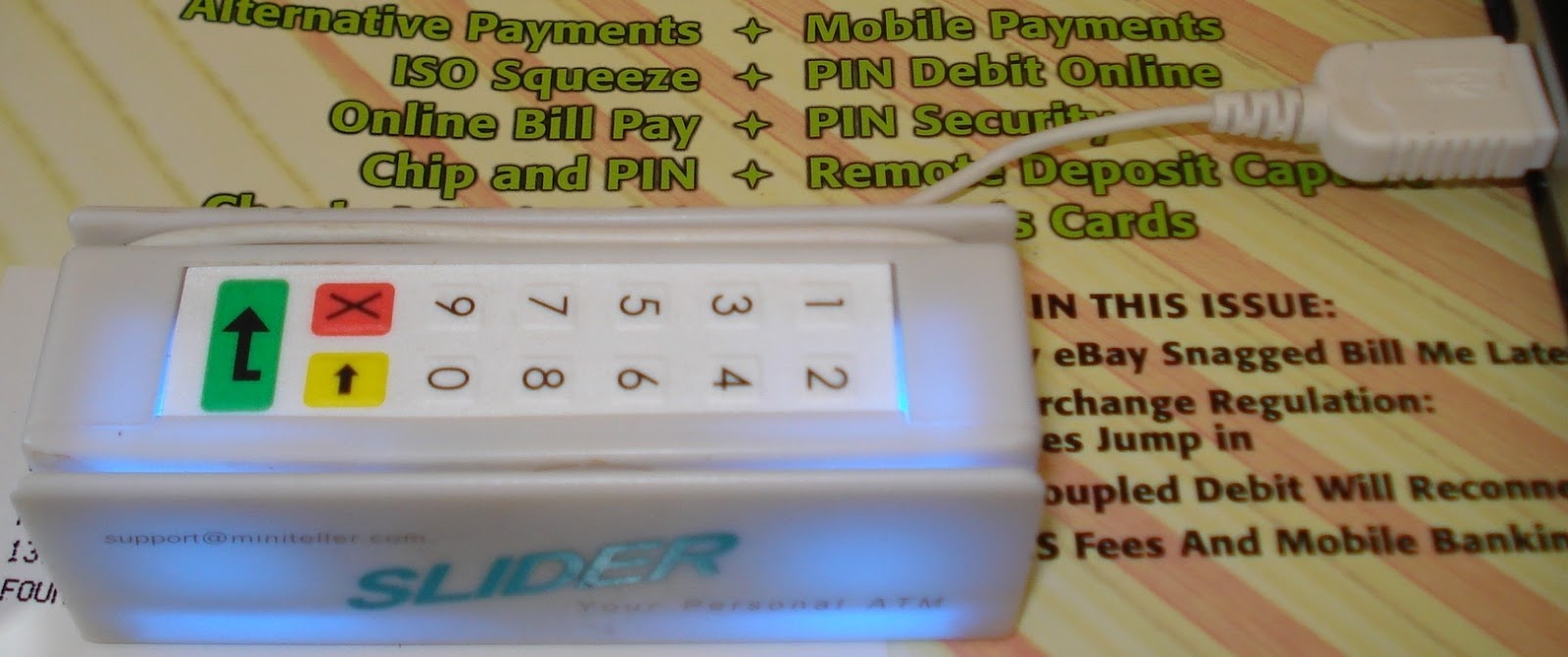

News ArticleEditor's Note: And a "REAL" ATM in your pocket can be NYCER yet! (real-time balance inquiries, real time money transfers, real time payments, and a real time saver when it comes to swiping vs. typing! That said, this is a great service from NYCE...

From BTN's John Adams:

Customer knowledge is a cornerstone of relationship building, and NYCE plans to extend balance information to consumers before they go to an ATM via mobile devices—a simple nugget of information the network hopes will attract banks eager to sell convenience to consumers.

NYCE will offer balance inquiries by text message to its financial institution participants as a standard feature of full participation in the NYCE Network.

The text message transactions will be an expansion upon balance inquiries that are available at NYCE Network ATMs, with no additional fees for mobilization. The new Monitise Americas-powered service will allow consumers to use text messaging to request and receive real-time balance information on their primary accounts. The balance inquiries will work for almost all mobile phone users regardless of their mobile carrier or the type of handset they use.

“It’s simple to execute and has no big download,” says Steven Rathgaber, president and COO of NYCE. “The right way to think about it is as an ATM in your pocket, at least from a balance inquiry perspective.”

The prevailing wisdom in mobile banking is balance inquiries are a primary point of entry, and Rathgaber says NYCE is trying to “decommoditize” the function by linking to the NYCE network, which provides consumers with secure, real-time access to their money, offering hundreds of thousands of ATM locations and millions of point-of-sale locations nationwide. Rathgaber would not say how many institutions have taken up the service, which is only a few days old.

A recent survey of North American consumers, commissioned by Monitise Americas and conducted by MaCorr Research1 found that more than 75 percent of consumers say having real-time information regarding their accounts was important. And of those who said they would like to use mobile phones for financial services, more than 90 percent said they are interested in basic information such as account balances.