In an article published by Reuters India, Ross Kerber is getting all fired up over the blame game. ("They both need to fight fraud and they are fighting each other")

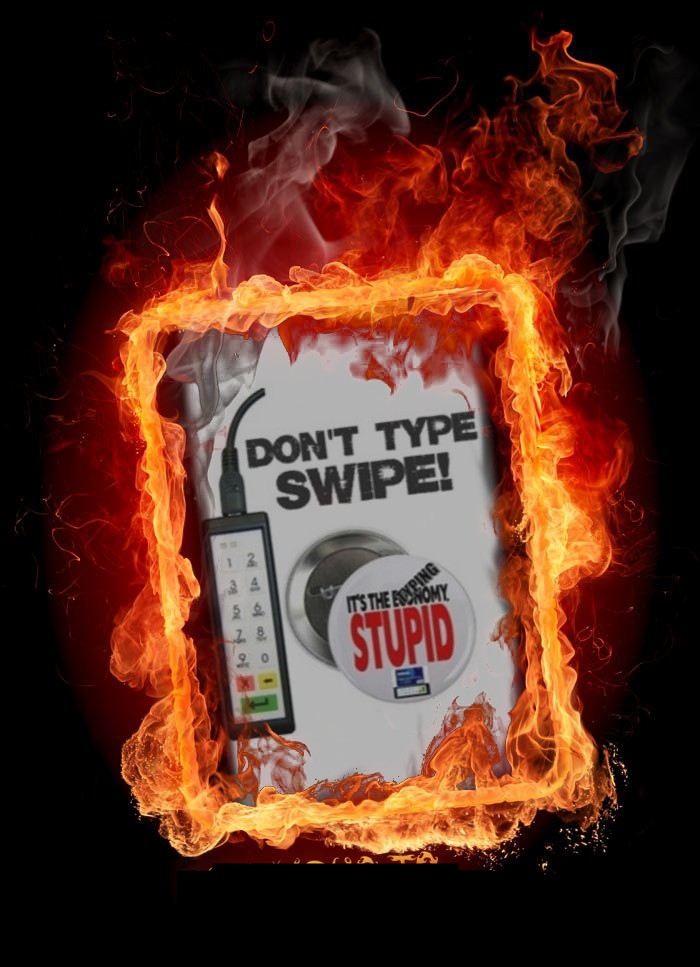

My two cents? It's the typing. You type, hackers swipe... Would you write the combination of your padlock on a post it note and attach it to the lock itself? Then why are we typing?

U.S. payment-card industry grapples with security | Reuters

By Ross Kerber

BOSTON (Reuters) - Fresh details of large-scale cyber attacks against data processor Heartland Payment Systems Inc and supermarket chain Hannaford Brothers show the challenges facing the efforts of the U.S. credit-card industry to upgrade security measures.

While both companies say their computer networks met the tough new standards meant to prevent data breaches, Visa Inc said Heartland at least may have let its guard down.

The positions reflect broader disagreements in the industry, as squabbling between merchants and financial firms over technology and the cost of systems upgrades continues to impede progress, said Robert Vamosi, an analyst for California consulting firm Javelin Strategy & Research.

"They both need to fight fraud and they are fighting each other," he said.The financial stakes are getting higher. Fraud involving credit and debit cards reached $22 billion last year, up from $19 billion in 2007, according to California consulting firm Javelin Strategy & Research.

The security of consumer information came under renewed scrutiny on August 17 when a 28-year-old Florida man, Albert Gonzalez, was indicted along with two other unnamed hackers for breaching the computer networks of Heartland and Hannaford, both of which said they were in compliance with security requirements.

Those standards were set by a council that includes the world's two largest credit card networks, Visa and MasterCard Inc; fast-food leader McDonald's Corp; oil major Exxon Mobil Corp; and big banks Bank of America Corp and Royal Bank of Scotland Plc.

All these companies face rising costs linked to fraud and its prevention. Of the 275,284 complaints received last year by the government's Internet Crime Complaint Center, 24,775 were tied to credit or debit card fraud, up from 13,033 in 2007 and 9,960 in 2006.

Continue Reading ...