E-commerce, mobile merchants experiencing higher losses, while international merchants are facing increasing threats

ATLANTA--()--Retailers incurred $2.70 in costs for every dollar in fraudulent transactions according to the 4th annual LexisNexis® True Cost of Fraud Study. The study utilizes the LexisNexis® Fraud Multiplier, which calculates the “true cost” of fraud incurred by merchants. That cost incorporates charge backs for merchandise, the fees and interest to financial institutions and payment processors as well as any replacement, redistribution or restocking fees incurred by a merchant. The study also reveals that retailers who offer mobile payments, e-commerce and sell internationally are becoming greater targets for fraud. In addition, the study quantifies the impact that fraud has on customer loyalty.

“With the size and pattern of fraud significantly impacted by global economic conditions and the move to mobile payments, this turbulent time requires merchants to be more vigilant than ever”

The 4th annual LexisNexis® True Cost of Fraud Study, conducted by Javelin Strategy & Research, examines how fraud affects retail merchants, financial institutions and U.S. consumers, as well as identifies and quantifies the losses involved in a fraudulent retail transaction.

Findings from the study show the cost of fraud is on the rise compared to last year. This year’s cost of $2.70 per $1.00 in merchandise is up $0.40 from last year’s level of $2.30. One of the areas of major fraud growth is the mobile sector. This year, mobile merchants paid $2.83 for every $1.00 lost compared to just $2.00 for 2011, an increase of more than 40 percent. The analysis in the study shows that criminals are shifting more attention to merchants that use a broader array of sales interaction methods, including browser, applications, text and evolving near-field communication methods.

The study also found:

- The LexisNexis Fraud Multiplier among international merchants has risen from 2.2 to 2.5 since last year, an increase of almost 14 percent per dollar of fraud;

- Only 39 percent of merchants believe that lower fraud rates can increase customer loyalty, meaning 61 percent don’t relate fraud reduction to improved customer loyalty; and

- 33 percent of consumers who fall victim to fraud avoid certain merchants. Thus, customer confidence is critical in maintaining and improving reputation and translates into return customers for merchants demonstrating they have earned that trust.

“With the size and pattern of fraud significantly impacted by global economic conditions and the move to mobile payments, this turbulent time requires merchants to be more vigilant than ever,” said Jim Rice, director, market planning, Retail and E-Commerce Markets, LexisNexis Risk Solutions.

“Our research clearly indicates that customers are less inclined to do business with merchants with which they’ve experienced fraud, yet a surprising majority of merchants surveyed in this study are not aware of this costly after-effect.”

The study was conducted through an online survey completed by a merchant panel comprised of more than 1,000 participants. The full report can be accessed by visiting http://img.en25.com/Web/LexisNexis/LexisNexis_2012_True_Cost_of_Fraud_Study.pdf

About Javelin Strategy & Research

Javelin Strategy & Research is the leading provider of quantitative and qualitative research focused on the global financial services industry. Our extensive quantitative data and deep analyst experience enable us to forecast the direction of the financial services market and make recommendations that empower you and your business to succeed.

About LexisNexisRisk Solutions

LexisNexis Risk Solutions (www.lexisnexis.com/risk/) is a leader in providing essential information that helps customers across all industries and government predict, assess and manage risk. Combining cutting-edge technology, unique data and advanced scoring analytics, Risk Solutions provides products and services that address evolving client needs in the risk sector while upholding the highest standards of security and privacy. LexisNexis Risk Solutions is part of Reed Elsevier, a leading publisher and information provider that serves customers in more than 100 countries with more than 30,000 employees worldwide.

LexisNexis® Retail and E-Commerce solutions protect your revenue, maximize efficiencies and enhance your ability to predict and protect fraud.

E-commerce, mobile merchants experiencing higher losses, while international merchants are facing increasing threats

ATLANTA--()--Retailers incurred $2.70 in costs for every dollar in fraudulent transactions according to the 4th annual LexisNexis® True Cost of Fraud Study. The study utilizes the LexisNexis® Fraud Multiplier, which calculates the “true cost” of fraud incurred by merchants. That cost incorporates charge backs for merchandise, the fees and interest to financial institutions and payment processors as well as any replacement, redistribution or restocking fees incurred by a merchant. The study also reveals that retailers who offer mobile payments, e-commerce and sell internationally are becoming greater targets for fraud. In addition, the study quantifies the impact that fraud has on customer loyalty.

“With the size and pattern of fraud significantly impacted by global economic conditions and the move to mobile payments, this turbulent time requires merchants to be more vigilant than ever”

The 4th annual LexisNexis® True Cost of Fraud Study, conducted by Javelin Strategy & Research, examines how fraud affects retail merchants, financial institutions and U.S. consumers, as well as identifies and quantifies the losses involved in a fraudulent retail transaction.

Findings from the study show the cost of fraud is on the rise compared to last year. This year’s cost of $2.70 per $1.00 in merchandise is up $0.40 from last year’s level of $2.30. One of the areas of major fraud growth is the mobile sector. This year, mobile merchants paid $2.83 for every $1.00 lost compared to just $2.00 for 2011, an increase of more than 40 percent. The analysis in the study shows that criminals are shifting more attention to merchants that use a broader array of sales interaction methods, including browser, applications, text and evolving near-field communication methods.

The study also found:

- The LexisNexis Fraud Multiplier among international merchants has risen from 2.2 to 2.5 since last year, an increase of almost 14 percent per dollar of fraud;

- Only 39 percent of merchants believe that lower fraud rates can increase customer loyalty, meaning 61 percent don’t relate fraud reduction to improved customer loyalty; and

- 33 percent of consumers who fall victim to fraud avoid certain merchants. Thus, customer confidence is critical in maintaining and improving reputation and translates into return customers for merchants demonstrating they have earned that trust.

“With the size and pattern of fraud significantly impacted by global economic conditions and the move to mobile payments, this turbulent time requires merchants to be more vigilant than ever,” said Jim Rice, director, market planning, Retail and E-Commerce Markets, LexisNexis Risk Solutions.

“Our research clearly indicates that customers are less inclined to do business with merchants with which they’ve experienced fraud, yet a surprising majority of merchants surveyed in this study are not aware of this costly after-effect.”

The study was conducted through an online survey completed by a merchant panel comprised of more than 1,000 participants. The full report can be accessed by visiting http://img.en25.com/Web/LexisNexis/LexisNexis_2012_True_Cost_of_Fraud_Study.pdf

About Javelin Strategy & Research

Javelin Strategy & Research is the leading provider of quantitative and qualitative research focused on the global financial services industry. Our extensive quantitative data and deep analyst experience enable us to forecast the direction of the financial services market and make recommendations that empower you and your business to succeed.

About LexisNexisRisk Solutions

LexisNexis Risk Solutions (www.lexisnexis.com/risk/) is a leader in providing essential information that helps customers across all industries and government predict, assess and manage risk. Combining cutting-edge technology, unique data and advanced scoring analytics, Risk Solutions provides products and services that address evolving client needs in the risk sector while upholding the highest standards of security and privacy. LexisNexis Risk Solutions is part of Reed Elsevier, a leading publisher and information provider that serves customers in more than 100 countries with more than 30,000 employees worldwide.

LexisNexis® Retail and E-Commerce solutions protect your revenue, maximize efficiencies and enhance your ability to predict and protect fraud.

Advertisement from IMI, the Publisher of ePayment News:

IMI creates and builds "breaking news" websites around industry specific keywords. Our proprietary "NewsBots" scour the web for specific keywords and once a breaking news story surrounding the keyword is found, it is sent to our server and edited into a news posting containing a Title, Photo, author credit, 25 word blurb and a direct link to the original content provider. The process is well served by the search engines and works as a traffic magnet. We will provide "targeted traffic" to any vertical, any niche, any subject. Click here to request more info Live Site Examples: Near Field Communication News or take a look at the "Breaking News Site" we built for the NBA's Miami Heat. NBANewsHeat.com Visit Breaking News = Traffic to learn how your industry related breaking news website can be a "targeted" traffic magnet.

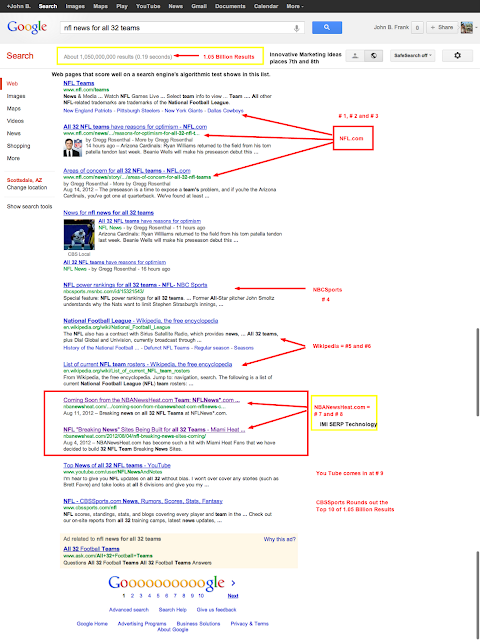

To provide you with an idea of the power behind our technology, we recently announced the upcoming release of NFLNews*.com (* denotes the name of the team) So let's use the search term: "NFL News for All 32 Teams." Relatively generic, and keep in mind we're competing with the likes of The NFL, ESPN, NBCSports, CBSSports, YouTube, Wikipedia, ABCSports, and myriad other established sites.

So how do we perform? Admirably.

Out of 1.05 Billion Search Results,

IMI is #7 and #8 (see below)

Out of 1.05 Billion Search Results,

IMI is #7 and #8 (see below)

Click the graphic below to enlarge: