May 5th, 2009 by Fiona Swerdlow, Head of Research, Shop.org

Today marks an annual milestone in the Shop.org calendar – we’re releasing to Shop.org Members the 2009 State of Retailing Online (SORO) Marketing Report. Much like last year, this report is the first installment of the three-part 2009 SORO research series that we produce in partnership with Forrester Research.

A few highlights:

Despite the economy, the Web channel perseveres. In addition to analyzing how trends and benchmarks are evolving in the online marketing space, this year we asked retailers how they perceive the impact of the economy on our industry. In general, over half of retailers surveyed told us they foresee slowing sales growth for the retail industry as a whole in the next twelve months. The Web channel, though, is quite a different matter: fully 80% of retailers feel that the online retail channel continues to be better suited to withstand an economic slowdown than other channels. For all the gloomy news we’ve heard of late, one third of retailers note that they have actually gained market share from competitors since the slowdown really hit in late 2008. Key performance indicators bear out this assessment further: for example, the average conversion rate still hovers between 3% and 3.5%.

Retention focus grows, but aquisition marketing still rules. We also asked retailers whether they had adjusted planned spending for their Web business this year. While almost half plan to stay the original course and spend largely as planned, approximately one third is ratcheting back spending, and the remaining quarter is actually increasing investment in their Web businesses beyond the original plan. Retailers cutting back will do so primarily in areas such as staffing and search, and by focusing on smaller initiatives. Those retailers now increasing spend for their Web business plan to further fuel areas such as search, email and social marketing, among other initiatives.

What does all this (and much more detail in the report) tell us? Looks like retailer focus on retention marketing this year has grown considerably in the past year – but acquisition marketing is as important as ever, signaling increased competition in the marketplace for customers and wallet share.

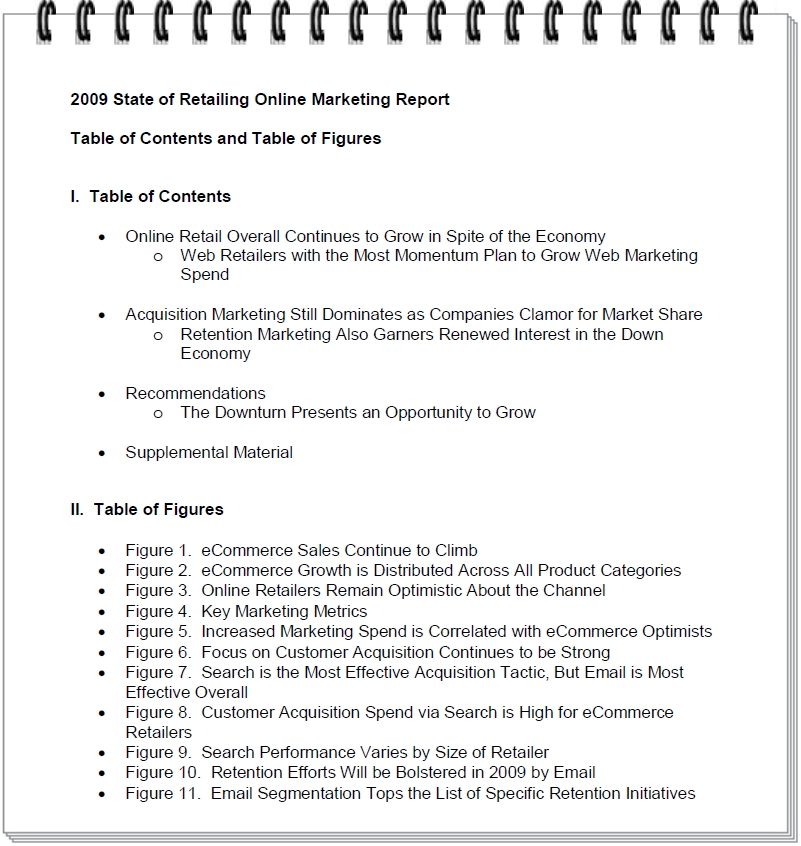

Read all about it… In addition to all of the areas noted above, the 2009 SORO Marketing Report also covers numerous other aspects of the online marketing world. These include retailers’ assessment of the effectiveness of various marketing tactics, both overall and specific to acquisition; customer acquisition spend; search performance metrics; and customer retention tactics and areas of focus this year. For several of these data points, we have been able to segment the data by either retailer size (measured in terms of total online sales in 2008) or type of retailer.

Shop.org Members may now download the full 2009 SORO Marketing Report. Our second SORO report, focusing on Merchandising, will be released in July in conjunction with the Shop.org Merchandising Workshop (see also more information about SORO). I look forward to your feedback on this research, and, if you are a retailer, to your participation in our next SORO survey later this spring.

Best – Fiona

State of Retailing Online (SORO)

Produced annually in partnership between Shop.org and Forrester Research, The State of Retailing Online (SORO) study is the highly anticipated research that brings details of Marketing, Merchandising and Profitability to the online retail community. This research serves many functions for retailers, from benchmarking performance in the marketplace, to highlighting marketing and merchandising best practices and guiding financial planning.

- SORO Survey Participation Sign Up

- SORO FAQ & Troubleshooting

- 2008 SORO Reports (members only)

- Purchase SORO

2009 Research Surveys and Reports

During the first half of 2009, Shop.org and Forrester Research are jointly deploying two surveys, designed to gather the most important details you need about marketing, merchandising, multi-channel integration, and profitability. The results of these two retailer surveys are being released in three separate reports: Marketing (May), Merchandising (July), and Profitability (September).

_________________________________________

2009 SORO Marketing Report

Released May 2009

The SORO Marketing Report covers areas such as:

- Marketing key performance indicators (KPIs)

- Impact of the current economic climate

- Marketing budget

- Allocation and effectiveness of marketing spending (both online and offline)

- Customer acquisition and retention

- Email marketing

- Search

Members, Download the Marketing Report

Non-Members: Purchase Here