TheBank for International Settlements has provided final guidance (PDF) on duediligence and transparency regarding cover payment messages incross-border wire transfers.

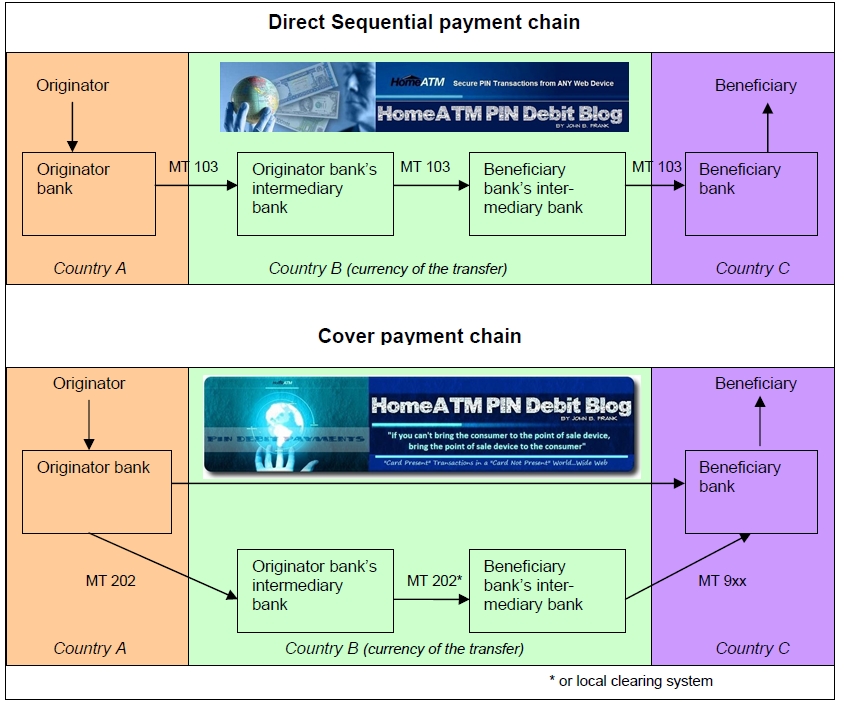

TheBank for International Settlements has provided final guidance (PDF) on duediligence and transparency regarding cover payment messages incross-border wire transfers.The new rules are intended to clampdown on the use of cover payments to hide the identities of wiretransfer recipients in support of regulatory initiatives on anti-moneylaundering and terrorism financing.

In January Lloyds TSB wasslapped with a $350 million penalty by the US Justice department fordeliberately falsifying wire transfers destined for countries orindividuals on US sanctions lists.

According to court documents,Lloyds deliberately removed material information - such as customernames, bank names and addresses - from payment messages so that thewire transfers would pass undetected through filters at US financialinstitutions.

The stripping of information allowed more than$350 million in transactions to be processed by US correspondent banksthat might have otherwise been blocked or rejected due to sanctionsregulations or for internal bank policy reasons.

Continue Reading at Finextra